Key Takeaways:

• Export sales target of $5 million.

• Company is looking to expand exports in Central Asia, Africa and Middle East regions.

• Management expects growth in volumes in 2QFY25 and 3QFY25.

• Management does not anticipate Gross Margin reaching 20%

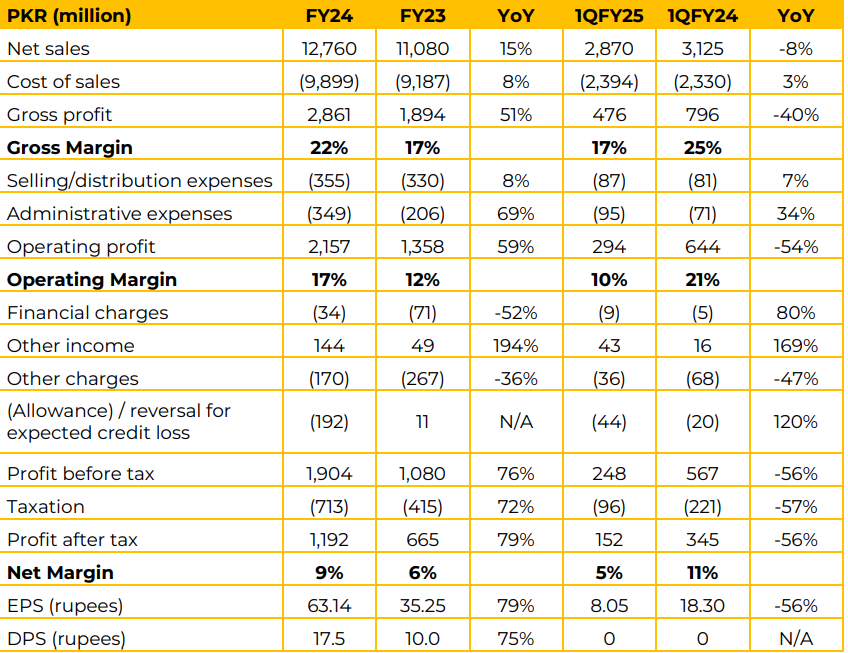

FY24 showed a strong 15% YoY increase in net sales, with improvement in gross margin to 22% in FY24. In 1QFY25, net sales declined by 8% YoY, while gross margin contracted sharply to 17% from 25% in SPLY. . FY24 saw a 52% reduction in financial charges, alongside a 194% jump in other income, significantly boosting profitability. In contrast, 1QFY25 was impacted by a decline in other charges (-47%) and higher non-recurring items (120%), which adversely affected PAT.

The Company is engaged in the manufacture and sale of formaldehyde, urea / melamine formaldehyde and moulding compound. The production facilities of the company are located in Hub-Balochistan and Gadoon-KPK. The Company began exporting to Afghanistan in FY23 with sales of Rs.45 million for the year.

This has increased to Rs.670 million in FY24. Further increases in export sales are anticipated. The management highlighted that in 1QFY25, the company has exported some shipments to Kenya and they are planning to expand their footprint in Central Asia and MENA region.

Installation of 1 MW of the solar energy system at the Gadoon factory in KP has resulted in significant energy cost savings over the year (now upgraded to 1.4 MW). Moreover. a similar system of 375 KW is being installed at the Hub factory in Baluchistan. This is in-line with making the company energy efficient, which is the major challenge for the company and the industry as a whole.

Higher energy cost coupled with inward freight on raw material and outward freight on export makes the product less competitive in the international market. The management also highlighted that there is a competition from cheaper imported material from China. While local players are trying to capture market share by providing extended credit facilities and engaging into price competition, due to which the company has to keep their prices competitive, thereby burdening their gross margin.

Going forward, the management anticipates the volume to improve in 2QFY25 and 3QFY25, in-line with the improve macroeconomic stability. The company is also targeting $5 million export sales

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.