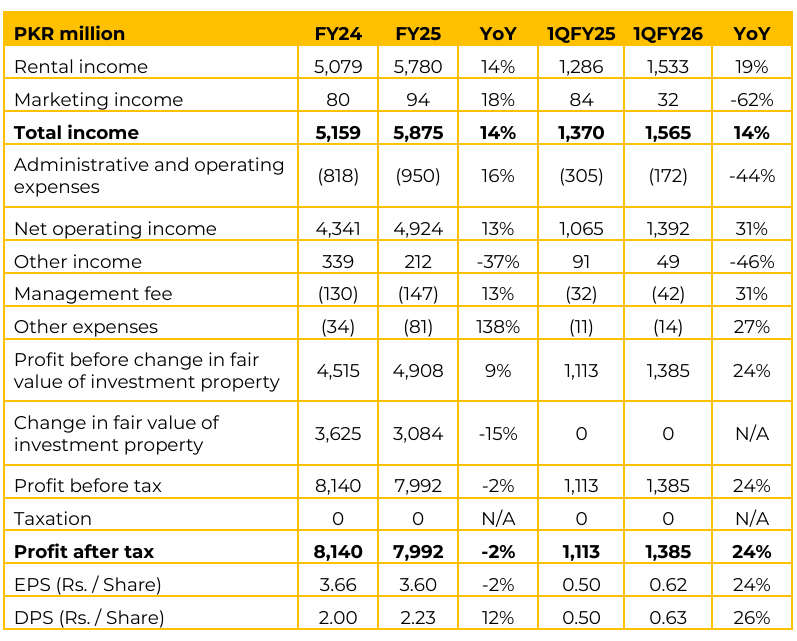

DCR reported earnings per share of PKR 3.60 in FY25 vs loss per share of PKR 3.66 in FY24. In 1QFY26, the EPS remained PKR 0.62 (1QFY25: 0.50). Average Rental Yield for Mall and Harbor Front is around 8%. Average Rent per Square Foot for all is PKR 650, and Harbor Front is around PKR 450.

Contractual annual rental increase is in the range of 10%. Management highlighted that more than 50% of the tenants have shifted to the revenue sharing model. Revenue sharing constitutes around 10% of the total rental collection. The model is not purely revenue sharing.

It is buffered by a base rent, with the revenue sharing element applied above the base rent. Management noted that tenants are highly transparent including multinationals or strong national organizations with POS implemented. Dolmen Mall Lahore’s REIT is planned to tentatively launch in 12-18 months. It will be a separate REIT not within DCR. Sky Tower A and B is not planned for IPO in the upcoming 12 months.

The addition of Sky Tower A, B, and the Executive Tower to DCR is not currently being considered. DCR does not currently have plans to acquire new properties to expand the existing portfolio. Key bottleneck stopping new REIT launches is the removal of the sunset clause in Section 99A, Second Schedule Part-I of the Income Tax Ordinance. Income from kiosks was reclassified from marketing income to rental income to better reflect its nature and for better presentation.

The REIT carries insurance coverage from the top three companies in Pakistan, including war and terrorism coverage. Management expects a growing dividend in coming years

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.