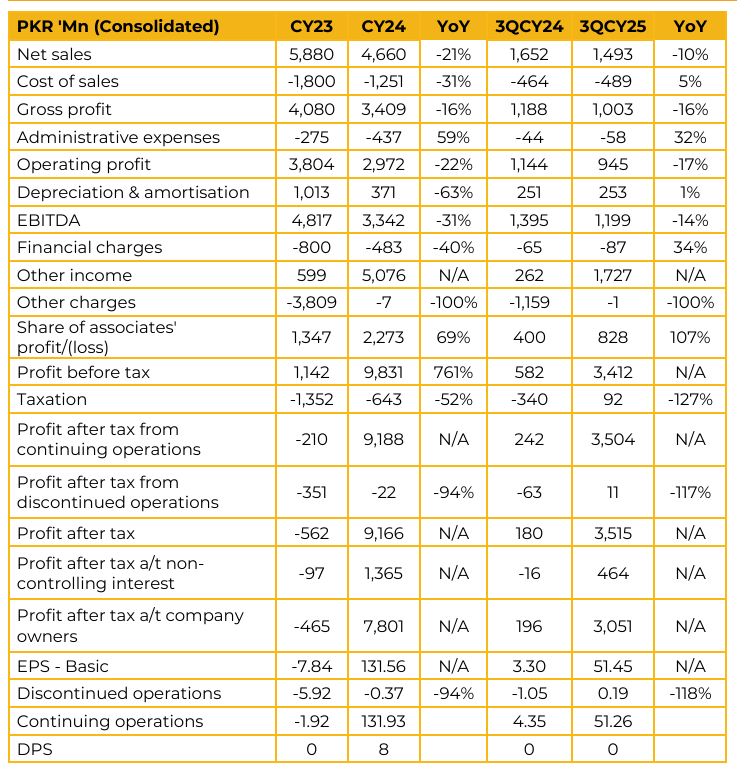

Dawood Lawrencepur Limited (DLL) reported consolidated earnings per share of PKR 131.93 for CY24, compared to loss per share of PKR 1.92 in CY23.

Furthermore, in 3QCY25, the company reported earnings per share of PKR 51.26, compared to earnings per share of PKR 4.35 in the same period last year (SPLY).

The Company’s equity portfolio stood at PKR 5.8 billion and delivered a strong 47.1% return, outperforming the market benchmark, which returned 43.7% over the same period. The wind power project at Gharo, which is a subsidiary of the Company, continued to perform reliably, maintaining availability of 99.03%. Energy invoiced during the period was 86.4 GWh, compared to 90.0 GWh in the same period last year, primarily due to higher curtailment and weaker wind speeds during the peak wind season. Despite this, Tenaga recorded the highest generation among the Gharo plants for the nine-month period and ranked fourth across the combined Gharo and Jhimpir WPP cluster, with a 31% capacity factor.

Management has proposed the amalgamation of Dawood Lawrencepur, Cyan, and DH Partners Limited to the Board in a recent meeting. All three are associate companies operating in the investment business, and combining them into a single entity is expected to result in improved governance, more efficient management, and a stronger consolidated balance sheet.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.