Key takeaways:

• Price/bag in south-region expected to increase.

• Dispatches to remain on the same level, amid subdued demand.

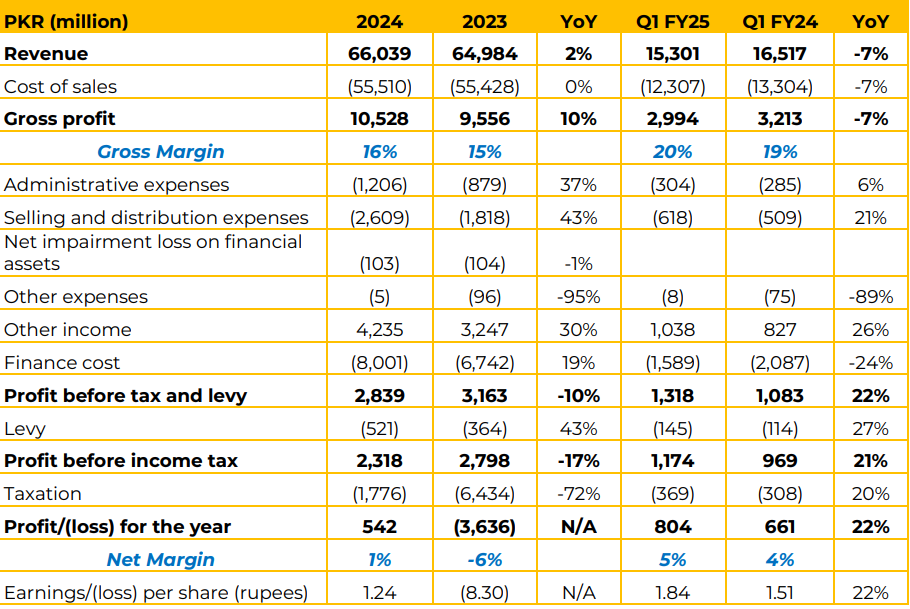

For FY24, DG Khan Cement’s revenue grew by 2% to PKR 66,039 million, despite a 7% decline in Q1 FY25 revenue (PKR 15,301 million) compared to Q1 FY24 (PKR 16,517 million). In FY24, the growth in revenue was driven by stable cement prices and increased clinker sales. Decrease in local dispatches was offset by clinker sales during the last quarter with minimal cash margins.

Company’s total dispatches decreased from 5,049,336 tons in FY23 to 4,845,688 tons in FY24, marking a reduction of around 4% YoY. On quarterly basis, the total dispatches rose from 1,173,814 tons in Q1 FY24 to 1,184,125 tons in Q1 FY25, representing a modest 1% YoY growth.

The Company maintained a strategic focus on boosting clinker exports to cover fixed costs, resulting in increase in export volumes compared to the corresponding period. However, the retention on clinker exports dropped considerably. Finance cost remained a significant burden, rising 19% YoY to PKR 8,001 million. Despite this annual increase, finance costs actually decreased by 24% in Q1 FY25, dropping to PKR 1,589 million from PKR 2,087 million in Q1 FY24.

The company’s net margin improved significantly from -6% in FY23 to 1% in FY24, reflecting a return to profitability. On a quarterly basis, net margin for Q1 FY25 was 5%, slightly above the 4% in Q1 FY24, indicating stable margin growth. Earnings per share (EPS) for the full year shifted from negative PKR 8.30 per share in FY23 to positive PKR 1.24 in FY24.

Regarding the coal mix, the company’s south-based plant currently uses 80% seaborne coal and 20% local coal, while the north-based plants utilize a combination of Darra and Afghan coal.

Additionally, the company’s coal inventory covers only about 15 days. Currently, in northern-region the cement price per bag is in a range of PKR 1,400 – 1,450 per bag, while in the southregion it’s PKR 1,200 per bag.

The managements expect prices in the south region to rationalize and increase going forward. The management highlighted that gas supply to the plants have been halted by the government.

However, they have other power generation units working and sees no difficulty. The company targets export sales to America as margins are better in this region. However, Sri Lanka, Bangladesh and Madagascar are their key export destinations. The management also anticipates some possibility to export to China, if Vietnam faces shortage. Going forward, the management sees no growth in dispatches in the ongoing fiscal year.

They anticipate the demand to remain subdued for at least one more year, despite the decline in interest rates. In response to some rumors regarding the acquisition of Attock Cement, the management declined any such intention.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose