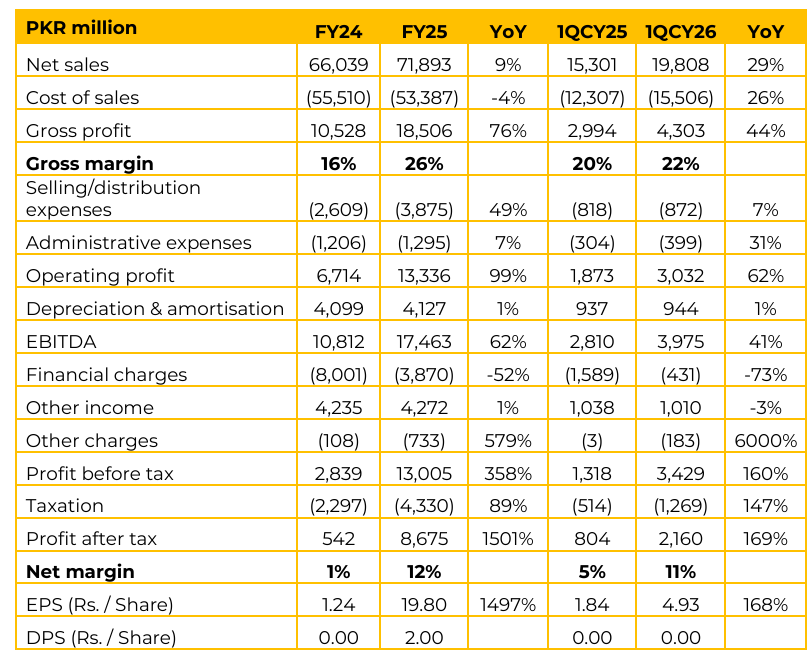

DGKC reported earnings per share of PKR 19.80 in FY25 (F24: 1.24). In 1QFY26, the EPS remained PKR 4.93 (1QFY25: 1.84). DGKC demonstrated significant resilience in FY25, operating at 79% sales utilization, which was meaningfully higher than the industry average of 55%.

This stability is attributed to the balanced distribution of North/South plants, the ability to serve export markets, and the strength of the operational structure. Total offtake increased by just over 2%, clocking in at 46.2 million tons. The local market remained subdued for the second consecutive year.

The industry momentum was carried by exports, which increased by 30%. The local market remained subdued for the second consecutive year. The industry momentum was carried by exports, which increased by 30%. DGKC continues to invest in efficiency. It added 3 MW to the solar power plant in Khairpur, which now totals 9.9 MW. DG Khan Cement USA LLC was incorporated during FY25 to assist with penetration in that market, but it is not yet operational. Nishat Packaging Limited serves as the major supplier for DGKC’s packaging needs.

It returned to profitability during the year, largely due to a one-time gain on the sale of a paper bag line. A new line, commissioned in 3QFY25, improved cost efficiency. Management notes that the polypropylene market is becoming increasingly competitive due to the industry shift away from paper bags.

Going forward, management views that the sector’s performance depends heavily on the policy environment, particularly government actions on housing, infrastructure, and taxation. Improvement has already been observed in 1QFY26, with an uptake in both local and export offtake. Management is cautiously optimistic. Post-flood rebuilding activity is expected to lift medium-term demand for cement.

The company expects double-digit growth for FY26/27. Management is exploring Middle East market for exports. USA remained a favorable market for export in terms of margin. Management has planned brownfield expansion in the North region, contingent upon improvement in the demand.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.