Gillette Pakistan Limited conducted a Corporate Briefing Session for shareholders, investors and analysts on October 28, 2024 at 10:30 A.M.

The management mentioned import duty impact and global commodity price increase as major challenges for the company.

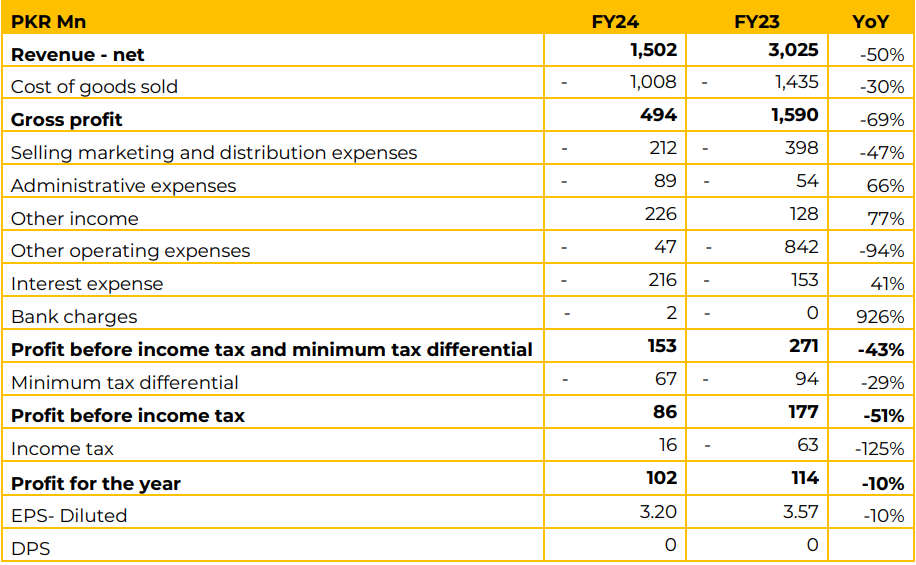

The company’s financial performance for FY24 shows a significant decline in net revenue, which dropped from PKR 3,025 million in FY23 to PKR 1,502 million.

Despite this, the cost of goods sold decreased from PKR 1,435 million to PKR 1,008 million, resulting in a gross profit of PKR 494 million, down from PKR 1,590 million in the previous year.

The gross margin for FY24 was 32.9%, a decrease from the 52.5% gross margin recorded in FY23. On the expense side, selling, marketing, and distribution expenses decreased from PKR 398 million to PKR 212 million, and administrative expenses increased from PKR 54 million to PKR 89 million.

Other income saw a rise from PKR 128 million to PKR 226 million. While, other operating expenses dropped significantly from PKR 842 million to PKR 47 million.

Despite these changes, the company’s profit before income tax fell from PKR 177 million to PKR 86 million, and the profit for the year decreased from PKR 114 million to PKR 102 million.

Consequently, the Earnings per Share also saw a slight decline from PKR 3.57 to PKR 3.20.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose..