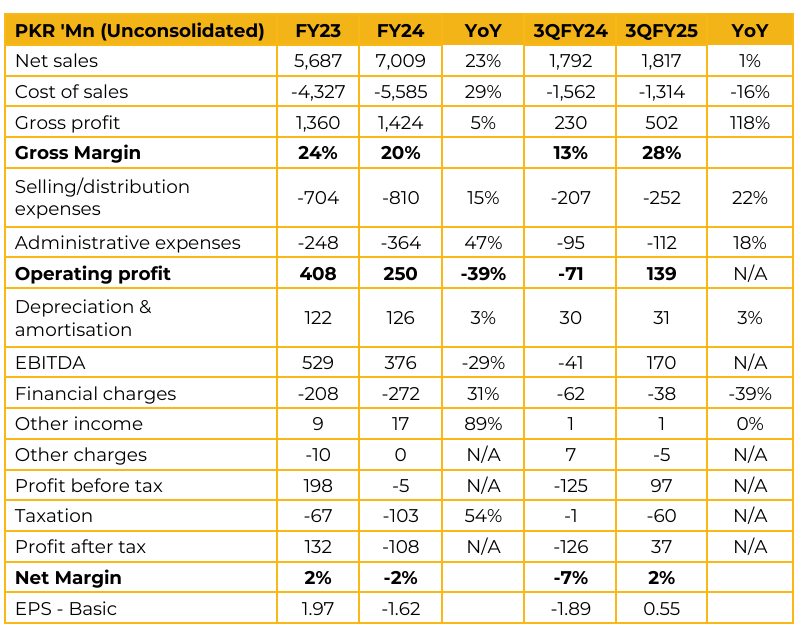

Bunnys Limited (BNL) reported loss per share of PKR 1.62 for FY24, compared to earnings per share of PKR 1.97 in FY23. Furthermore, in 3QFY25, the company reported earnings per share of PKR 0.55, compared to loss per share of PKR 1.89 in the same period last year (SPLY). The company has installed a 200 KVA solar system, with an additional 200 KVA currently in the pipeline and expected to come online soon.

Against a total energy requirement of 1 MW. In parallel, the company has also initiated the use of biogas fuel, which is approximately 30% cheaper than conventional alternatives due to the plant’s proximity to the factory.

As the biogas plant expands capacity, the company plans to increase its reliance on this source further. According to management, the company holds a Gold Certification from the American Institute of Baking—the only company in the country to possess this accreditation.

This certification enhances credibility and serves as a key reason multinational clients procure from them, with such sales largely driven by order-based demand. The company is also revisiting its distribution model for the snacks category, aiming to relaunch products nationwide in September. In Punjab, the company commands around 32% market share in the bread and bun segment.

Currently, bread contributes ~60% of revenues and cakes ~20%. Distribution of snacks has been on hold for the past 5–6 months. According to management, the majority of revenue growth is being driven by higher volumes. However, recent floods may put upward pressure on flour prices, potentially causing a 1–2% decline in margins. Since bread is a regulated product, the company cannot directly pass on the impact to customers.

The company has also launched operations in Islamabad, addressing market demand concerns around product shelf life. Presently, it operates a single shift but has the flexibility to move to double-shift production if demand rises. Additionally, there is sufficient vacant space available to accommodate future capacity expansions. In the snacks segment, operations were previously running at 50% capacity. The decision to revamp the distribution cycle stems from the mismatch between the sales cycle of perishable bread and that of snacks. The new strategy is expected to better align supply with market demand.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.