Key Takeaways:

• Biafo leads the Oil & Gas sector with long-term contracts.

• Biafo Industries is closely monitoring the Reko Diq project’s feasibility and is prepared to capitalize on any business opportunities if arises.

• Sales grew in the mining and cement sectors but declined in Oil and Gas due to economic and security challenges.

• The company plans expansion in South-Asian, African, and Gulf markets.

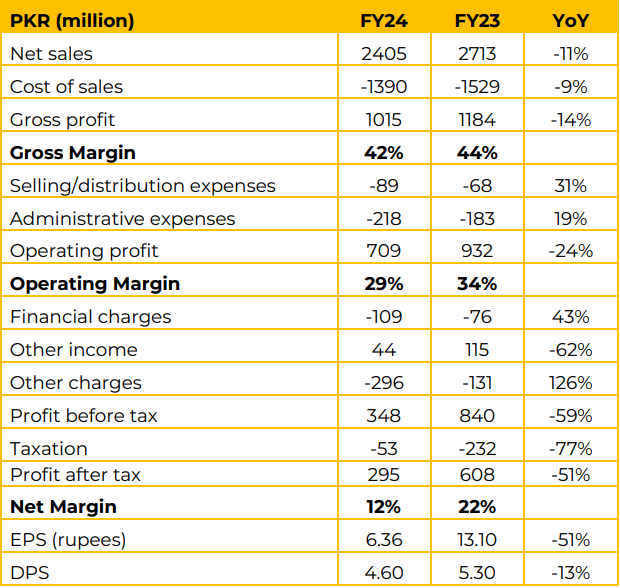

In FY24, the Company achieved net sales revenue of Rs. 2,405 million, compared to Rs. 2,713 million in the FY23. Gross profit decreased by 14.30% to Rs. 1,015 million (FY23: Rs. 1,184 million).

The Company posted a net profit after tax of Rs. 295 million (FY23: Rs. 608 million), resulting in earnings per share of Rs. 6.36 (FY23: Rs. 13.10). .

The decline in profitability is due to higher finance costs, reduced sales from the economic downturn, and an impairment loss on overdue export proceeds from a Sudanese customer affected by political unrest. However, the management has received assurances that the funds will be released.

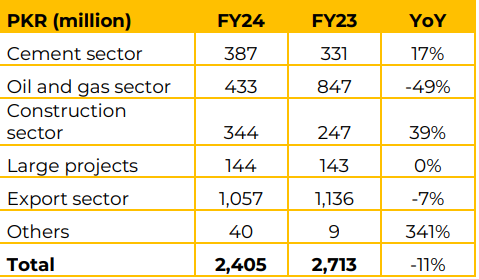

The company saw an improvement in supplies to the mining and cement sectors during the year. However, supplies to other sectors declined, largely due to the broader economic downturn and security challenges, particularly in the Oil and Gas exploration sector. Segregation of revenue based on customer segmentation

The management anticipates that the market situation will improve once the economy stabilizes and infrastructure projects resume. The sales also include revenue from the Saindak and Dudder projects in Balochistan. Moreover, the company is keenly observing the developments regarding the feasibility of Reko Diq, and looking forward to tap any business opportunity (if arises).

Current market share of Biafo is 34-35%, Wah Noble remains at 40%, while others share is 25%. The management highlighted that Biafo is the market leader for commercial explosives in Oil & Gas Sector. It enjoys long-term contracts with Mari & ODGC. Biafo engages in seismic surveys with these companies.

Going forward, the company plans to expand its footprint in South-Asian, African and Gulf markets. Moreover, the management expects good business in the mining & exploration segment, once the economic activity revives. The Company also places a strong emphasis on Research and Development to create innovative and cost-effective products that meet evolving market demands.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.