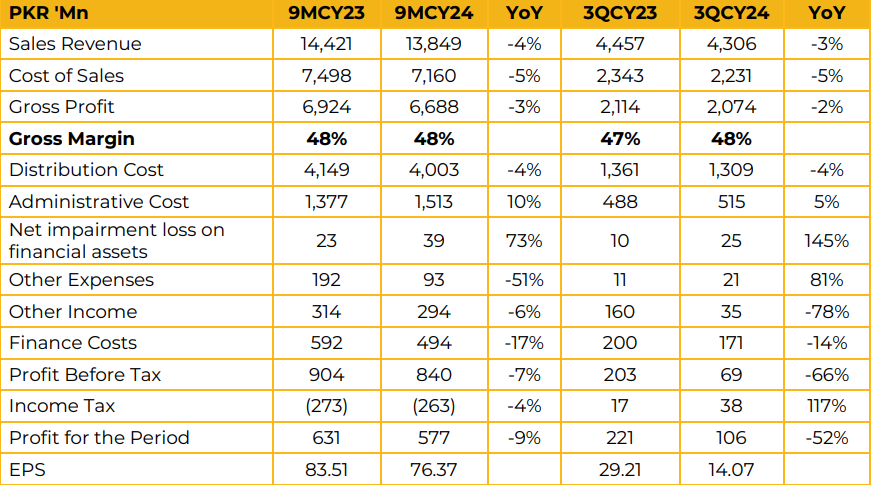

In 9MCY23, Bata Pakistan Limited reported a net profit of PKR 577.36 million (EPS: PKR 76.37), reflecting a 9% YoY decline compared to PKR 631.35 million (EPS: PKR 83.51) in the SPLY. The company’s topline decreased by 4% YoY, reaching PKR 13.85 billion in 9MCY23, compared to PKR 14.42 billion in the SPLY. Gross profit declined by 3% YoY, amounting to PKR 6.69 billion versus PKR 6.92 billion in the SPLY.

Gross margin remained stable at 48%, despite the imposition of an 18% sales tax in FY24. Management attributed the topline decline to reduced consumer purchasing power caused by higher inflation. The back-to-school season was also impacted for similar reasons in CY23.

However, management noted improvements in macroeconomic conditions and consumer confidence, with expectations of increased sales moving forward. Bata’s retail network consists of more than 400 stores across Pakistan. Over the last two years, the company has opened 100 franchises.

Furthermore, 350 stores have been integrated with the ISS system. The company has also expanded into Tier-III and Tier-IV cities. The sales mix comprises 20% women’s shoes, 15-20% children’s shoes, and the remainder men’s shoes. Approximately 30% of total sales come from sneakers for both men and women. Retail store sales contribute 83% of total sales, 4-5% come from online platforms, and the rest from franchises and B2B channels.

The company’s market share stands at 22-25% in the formal footwear sector and 10-12% in the overall industry. Management clarified that discounting is not a permanent strategy but is employed to remain competitive. Despite offering discounts, the company successfully maintained higher margins.

Going forward, Bata does not plan significant network expansion. Instead, it aims to open larger stores, sustain margins through smart pricing strategies, and enhance product quality.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.