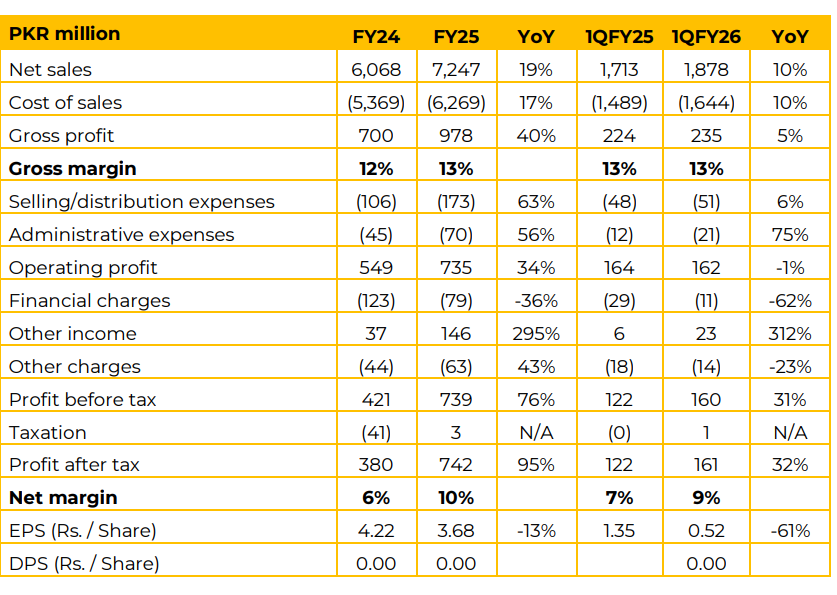

BFAGRO reported earnings per share of PKR 3.68 in FY25 (F24: 4.22). In 1QFY26, the EPS remained PKR 0.52 (1QFY25: 1.35). Profit after tax grew by 95% to PKR 742 million inFY25 (FY24: PKR 380 million). While, in 1QFY26 profit after tax grew by 32% to PKR 161 million (1QFY25: PKR 122 million). BFAGRO operates in Special Economic Zones in both Karachi and Faisalabad, which provides a tax exemption benefit.

The tax exemption for the Karachi plant commenced in 2019. The exemption date for all companies in Faisalabad SEZ is now expected to expire in 2035 due to recent budget changes. The normal tax rate “29%” will become applicable after 2029 for Karachi plant.

The management expects that by 2029, the company will be mature enough to charge higher prices and protect margins by passing on the tax increase. BFAGRO produces customized egg products by processing liquid egg and adding sugar, salt, or enzymes as per customer requirements.

Products are categorized into three main forms: Chilled (fresh form), Frozen, and Dried. These forms are available as whole egg, egg yolks, and egg whites. The company exports products to eight different countries, mainly in the GCC region. Currently, the sales mix is 20% from exports and 80% from the local market. Management aims to increase exports to 25-30% but views the local Pakistani market as the main focus.

Pakistan’s total addressable market for processed industrial eggs is around 150,000 tons. BFAGRO covered almost 10% of the existing market, selling around 15,000 tons last year. According to the management, Pakistan’s per capita egg consumption is 90 eggs which is low compared to worldwide standards, indicating phenomenal future growth potential in the egg business. The company is expanding it’s capacity by 12,000 MT through establishing a factory at Faisalabad (tax free zone).

The strategic location will enable to service the entire central and northern parts of the country which is witnessing higher growth compared to other parts of the country. The project is expected to be completed within expected timelines i.e. March 2026.

The company is the biggest buyer of eggs in Pakistan with daily procurement of approx. 850,000 eggs which is expected to increase to 1.8 million eggs in next few years. In order to reduce the risk of price volatility and sustainable growth, the company has initiated plans to do backward integration by setting up farms and feed operations. The aim is cover at least 50% of the raw material requirements in house in the next few years.

The company aims to utilize the full 29,000-ton capacity (with the new Faisalabad plant) within the next four years. Land acquisition and equipment procurement is in process right now. Management expects a significant increase in Gross Profit and Net Profit.

Conservative estimate is a profit of 3 rupees per egg translated into earnings from the poultry farm operation. The company aims to raise PKR 200 million through debt for this project. Going forward, the company is setting up 1,200 MT egg powder processing facility at its existing factory in Karachi.

Currently, the company is producing chilled and frozen categories. Egg powder offers high shelf life and low transportation/storage costs, making it suitable for export markets, especially those lacking cold chains. The company is experiencing a high export demand for this product.

Construction is expected to start in January. Expected operationalization is expected around October/November of next calendar year. Total project cost is around PKR 500 million Financing is a 50/50 mix: PKR 250 million will be financed through debt, and the remaining 50% will come from internal sources. A wholly owned subsidiary has been set up in UAE. This base in Dubai is intended to help further penetrate the GCC and African markets

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.