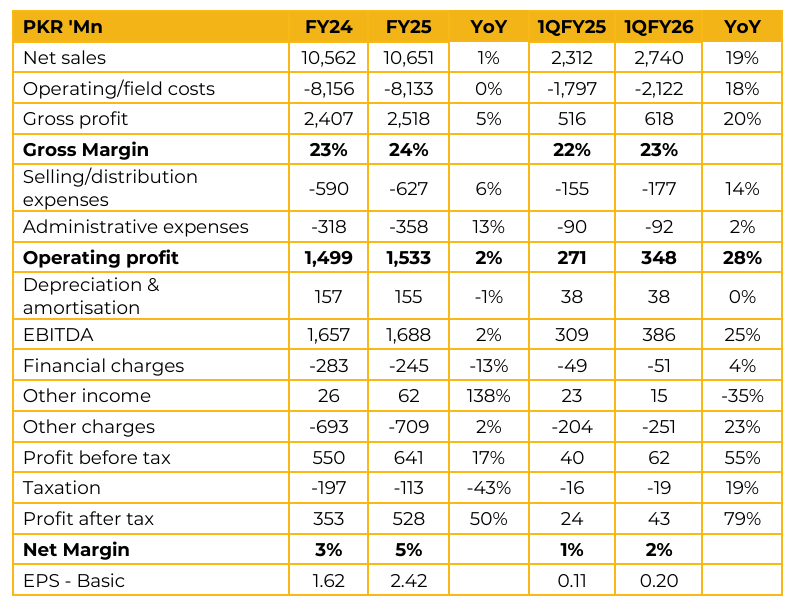

At-Tahur Limited (PREMA) reported earnings per share of PKR 2.42 for FY25, compared to earnings per share of PKR 1.62 in FY24. Furthermore, in 1QFY26, the company reported earnings per share of PKR 0.20, compared to earnings per share of PKR 0.11 in the same period last year (SPLY).

Overall, management emphasized that the strategic direction of the business is to continue diversification, reducing reliance on fresh milk and increasingly shifting toward higher margin, value added product categories. Management also highlighted that the company has obtained regulatory approvals for the production of edible oil.

Under this arrangement, Minha Oil will handle production and market the product under the Prema brand name. Management reiterated that the primary driver of volatility in reported EPS is the fair value gain on biological assets, which creates swings in accounting profit despite stable underlying operations.

The company is intensifying its focus on deepening penetration in the Karachi market. Currently, one 40-foot container of milk and one 20-foot container of eggs are shipped weekly, with plans to increase frequency as demand scales. Value-added products remain a key margin contributor, with eggs and honey both generating strong double-digit margins. The company is also progressing on a biogas initiative in partnership with Clover.

Under this project, Clover will utilize cow dung to fuel biodigesters that produce methane to operate power generators. The initial generation target is 500–600 kW, with expansion potential beyond 1 MW in subsequent phases. The farm’s current herd size stands at approximately 6,500 animals, with a typical 50:50 split between mature animals and calves.

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.