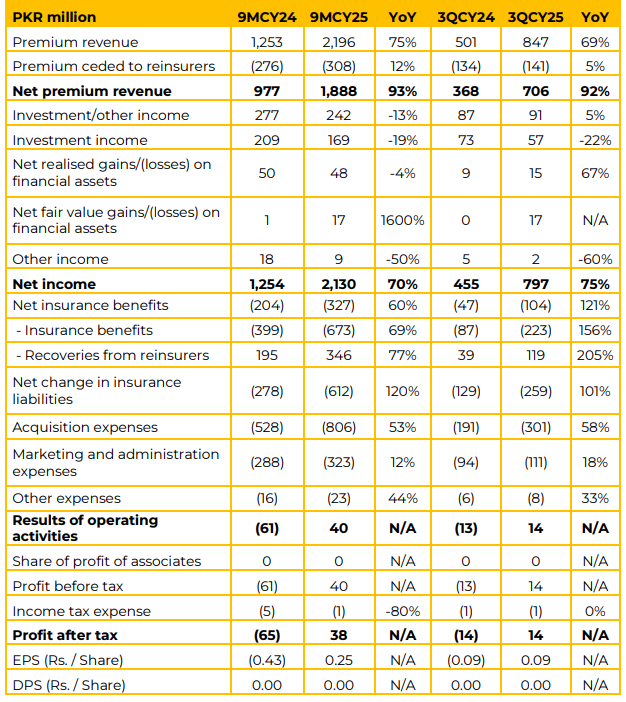

ALAC reported earnings per share of PKR 0.25 in 9MCY25 vs loss per share of PKR 0.43 in 9MCY24. Furthermore, in 3QFY25, EPS remained PKR 0.09 (LPS 3QCY24: 0.09). The fund size managed on behalf of policyholders is almost PKR 3 billion. The investment portfolio currently managed is approximately PKR 2.3 billion. Main distribution is conducted through the Agency channel and Bancassurance.

The company operates two channels, conventional Insurance and sharia-compliant Takaful. Child Education plans are the most popular in the market. Retirement Planning entails exclusive plans offering pensionlike features. Family cover and riders are for covering life or sickness.

There are also specialized products for the Armed Forces and Higher Net Worth Customers. Bancassurance agreements are active with Al Baraka Bank, and an agreement with U-Bank is starting. Agency networks is spread over approximately 80 locations across Pakistan, covering different cities and towns, facilitating door-to-door retail sales. ALAC markets the “Mahfooz Saving Plan,” specifically designed for the Armed Forces. ALAC is described as the only company in Pakistan that sells directly to the Armed Forces in cantonment areas.

The majority of the business (90-95%) is derived from the open market/private segment (retail customers). The Armed Forces portfolio is very limited, estimated at 5-7%. Going forward, company plans to include digital products that will sell online without human interaction, in line with SECP guidelines.

The primary investment focus is on Government Securities to secure policyholders’ savings. Smaller portions are invested in Mutual Funds and, more recently, exposure has been started in the Stock Market/Equity through three special managed accounts.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.