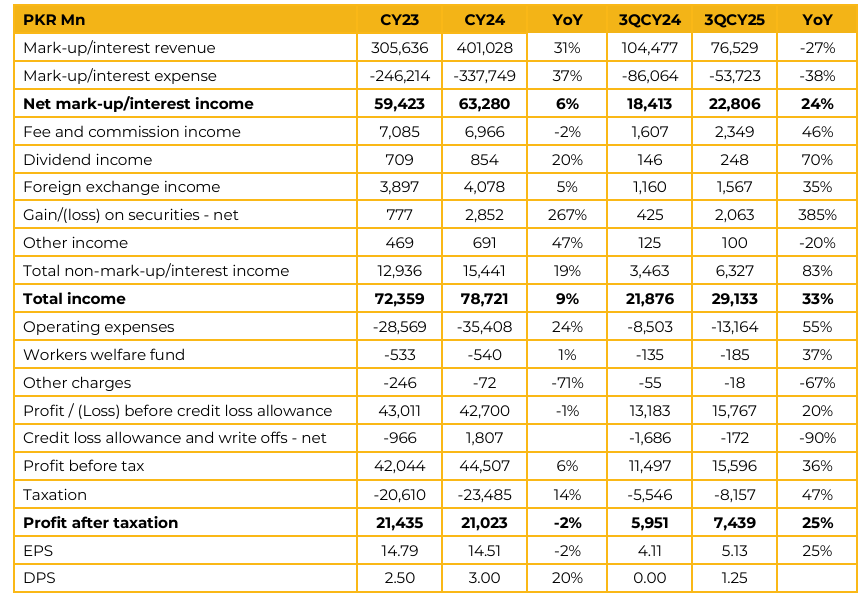

Askari Bank Limited reported earnings per share of PKR 5.13 in 3QCY25, up 25% from PKR 4.11 in 3QCY24. This translates into profit after tax of PKR 7.4 Bn compared to PKR 6.0 Bn in SPLY. The bank declared a dividend of PKR 1.25 per share in 3QCY25 compared to no dividend in 3QCY24.

The management highlighted that it plans to maintain quarterly dividends policy in the future. Total revenue in 3QCY25 reached PKR 29.1 Bn against PKR 21.9 Bn in 3QCY24, an increase of 9%. This was primarily driven by a 19% increase in non-mark-up income from PKR 12.9 Bn in 3QCY24 to PKR 15.4 Bn in 3QCY25.

The bank saw its total deposits rise from PKR 1.36 Trn at the end of CY24 to PKR 1.52 Trn at the end of 3QCY25, an increase of 11%. Current & savings accounts now stand at 84% of the bank’s deposit base out of which 30% is current accounts. Going forward, the management expects its total deposit growth to remain in line with industry trends with current accounts deposit growth to outpace.

Investments stood at PKR 1.97 Trn at Sep-2025, up 30% from PKR 1.51 Trn at the end of CY24. The mix between fixed and floating rate PIBs is 85:15 with an average maturity of 2.5 years and a yield of about 13% on fixed rate PIBs. The bank’s gross ADR stood at 38.7% as of Sep-2025, down from 53.8% as of Dec-2024. On the other hand, the CAR ratio improved to 22.7% as of Sep-2025 compared to 21.4% as of Dec 2024.

Similarly, the bank’s cost to income ratio declined to 44% compared to 48% in SPLY. However, the bank highlighted that due to ongoing expansion of both headcount and tech infrastructure it sees this rising to near 50% in the future but not significantly higher.

The bank also expects over 50% of its branches to be Islamic by the end of this year. Alongside this, the management also hopes to push for a ratings upgrade once the audited financials for CY25 are published. Moving forward, the management apprised that their focus for profitability will remain on increasing low-cost deposits to counter margin compression and integration of technology and AI to modernize and scale their operations.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.