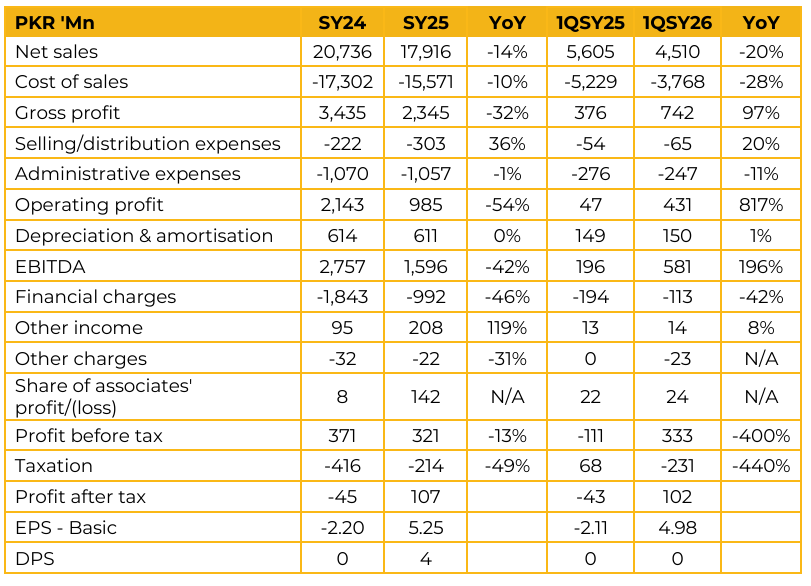

Al Noor Sugar Mills Limited (ALNRS) reported earnings per share of PKR 5.25 for SY25, compared to loss per share of PKR 2.20 in SY24. Furthermore, in 1QSY26, the company reported earnings per share of PKR 4.98, compared to loss per share of PKR 2.11 in the same period last year (SPLY).

The company remains a pioneer in the Medium Density Fiberboard (MDF) market, operating two primary production lines: the Mande Line, which produces thin boards of approximately 3.2mm typically used for partitioning applications, and the Sunds Line, which focuses on thicker sheets in the 16–18mm range.

Production declined slightly to 63,867 cubic meters compared to 67,512 cubic meters SPLY, primarily due to a 25-day planned maintenance shutdown. Despite the temporary reduction in output, management indicated that domestic demand for the “Lasani” brand remains robust. In the sugar segment, the sugarcane rate at the start of the crushing season commenced at PKR 400 per 40kg and has since stabilized in the PKR 440–450 range. The seasonal average price is now expected to close around PKR 465 per 40kg.

Current ex-mill prices are hovering at PKR 137–140 per kg, which remains below the projected cost of production. However, profitability in 1QFY26 was supported by the sale of carryover inventory that had been realized at higher prices in the PKR 165 175 per kg range, providing a temporary margin cushion. Management estimates that the total cost of production for the current season will fall between PKR 147 and PKR 150 per kg. The company also operates a 36 MW bagasse-fired power plant, of which approximately 10 MW is consumed internally. While the facility has the capacity to supply surplus power to the national grid, management noted that doing so is currently not economically viable given the rising market price of bagasse.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.