Key Takeaways:

• Dividend distribution policy of 50% payout aimed to be followed.

• Bottlenecks in app have been resolved

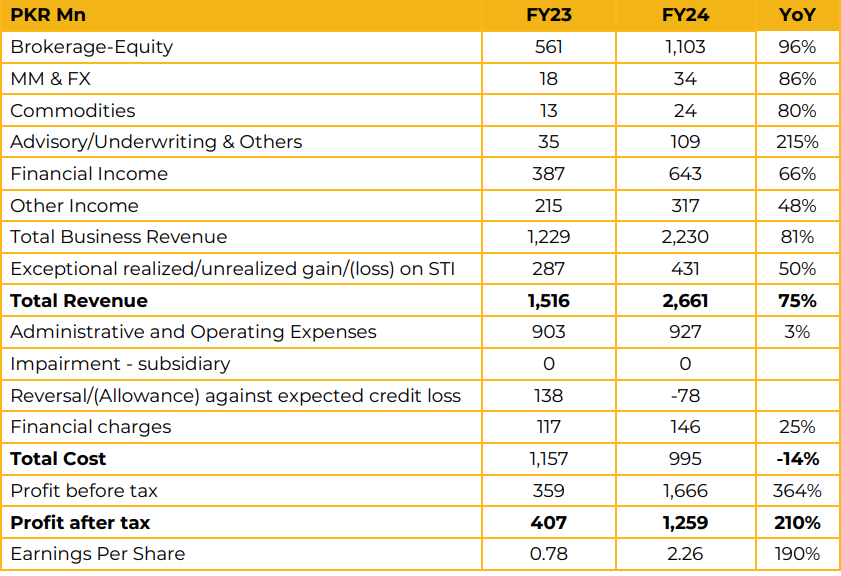

AKD Securities Limited reported earnings per share of PKR 2.26 in FY24 against earnings per share of PKR 0.78 in FY23, an increase of 190% Total revenue in FY24 reached PKR 2.66 Bn against PKR 1.52 Bn in FY23, an increase of 75%. The company has launched a new application this year and after initial hiccups during high load periods it is now operating with no breakdowns.

AKDSL maintains a 15% market share in brokerage on the basis of volume which has remained steady. There is strong growth in the debt market where rent seeking investors are availing the newly listed GOP sukuk instruments. The company currently has 7 transactions in the pipeline for its investment banking department.

Going forward, management expects volumes at the exchange to sustain with a renewed interest from foreign investors given exchange rate stability.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.