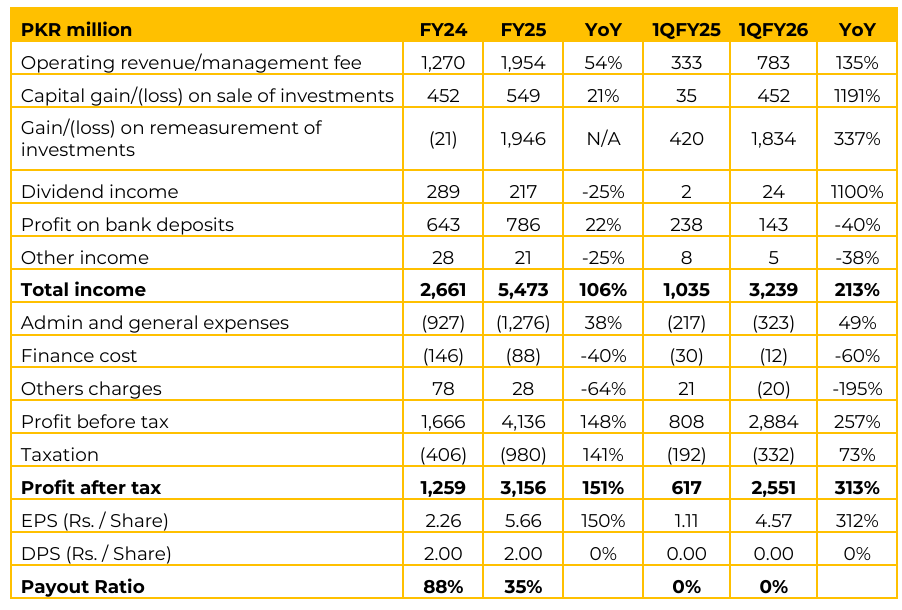

AKDSL reported earnings per share of PKR 5.66 in FY25 (F24: 2.26). In 1QFY26, the EPS remained PKR 4.57 (1QFY25: 1.11). AKDSL is described as the largest sell-side brokerage house in Pakistan. Management noted that while they used to say “one of the largest,” they now believe they are “The Largest” Corporate Brokerage House operating out of Pakistan.

The primary objectives are to strengthen market share, deepen client engagement, and expand footprints into new verticals. Maintains a robust system for client engagement, including a State-of-the-Art Call Center and a robust online trading platform. Investment banking often advises clients against rushing to equity listing.

If clients are not ready or are seeking high valuations (e.g., 10x to 12x multiples), AKDSL advises them to pursue Sukuk (Islamic instruments with identified assets) first, as a mezzanine round before hitting the risky equity market.

Listing costs vary by size. For small capital listings, the total expense (government, advisors, system costs) is approximately 5-6%. For listings of PKR 2.5 billion and above, the percentage decreases slightly. This is a one-time cost. The Money Market desk serves as a revenue driver, catering to a wide client base including banks, DFIs, AMCs, Corporates, Mutual Funds, and Retail.

Management noted that while the PE ratio has more than doubled over the past year, it remains below the 2017 averages and previous IMF program levels. Management believes that Equity will be the preferred asset class in the times to come. The market has historically traded at a 13x P/E multiple; if the market returns to this multiple based on current earnings, the index could reach approximately 250,000 points.

The company recommends distributing 30% to 50% of earnings, though this is not a strict policy. Retaining profits during high market growth was viewed as beneficial, allowing the flow-back of profit to aid company growth and benefit shareholders.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.