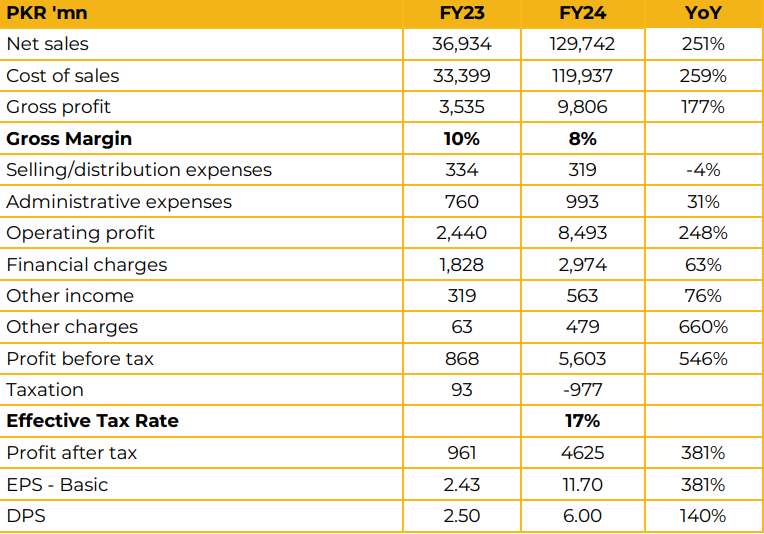

• Air Link Communication Limited reported earnings per share of PKR 11.70 in FY24 against PKR 2.43 in FY23, an increase of 381%.

• The company reported a growth of 251% in net sales reaching PKR 130 Bn in FY24 against PKR 40 Bn in FY23.

• Gross profit was reported at PKR 9.8 Bn in FY24, up 177% from PKR 3.5 Bn in FY23.

• Profit after tax for FY24 was recorded at PKR 4.6 Bn, up 381% compared to PKR 1 Bn in FY23.

• The company’s facility for Tv manufacturing is now complete, inspected and ready for production. The management expects production to begin by the end of November.

• TV SKDs are expected to arrive in the first week of November. The products are expected to hit the market in the first week of December.

• The expected Gross Margin on TVs is 15-18% with expected net margin of 7-8%. The sales target for half year is 50,000 sets and 100-120,000 for next year.

• Work on the laptops production facility is ongoing and the company expects the launch of the product by March 2025. The expected capex for this project is expected to be a maximum of US$ 500k.

• The management expects margins from the laptop segment to be similar to those of TVs.

• The company is also working with the government and is hopeful that a barcode system will be introduced to curb smuggling of tvs and laptops. Additionally, the company hopes that the government will introduce duties on used laptops

• The company aims to introduce acer laptops below the 100,000 PKR price point to target those buying imported used laptops currently.

• With regards to its core business of mobile phones the management highlighted that its current capacity utilization stands at 40% and as such they hope that a mobile phone export policy will be introduced allowing them to use the excess capacity.

• The management was of the belief that it is not sustainable to exports phones without a policy introduced by the government.

• They also highlighted that the company’s product ranges from PKR 2k to PKR 500k in price comprehensively covering all consumers in the market.

• Revenue growth for the next year is expected to be 10-20% in mobile phones with the new segments further contributing to growth.

• The company highlighted that Xiaomi EVs had been imported for a survey only and there are no plans for distribution or manufacturing yet. It was also brought to light that any manufacturing project for cars would cost over US$ 500 Mn and would require investment from the joint venture partner.

• The CEO also clarified that he had not begun liquidating his blocked holding but rather had sold shares he had acquired out of the free float 2 years ago.

• Going forward, the company is hopeful of growth prospects with many projects in the pipeline which could further increase its profitability.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.