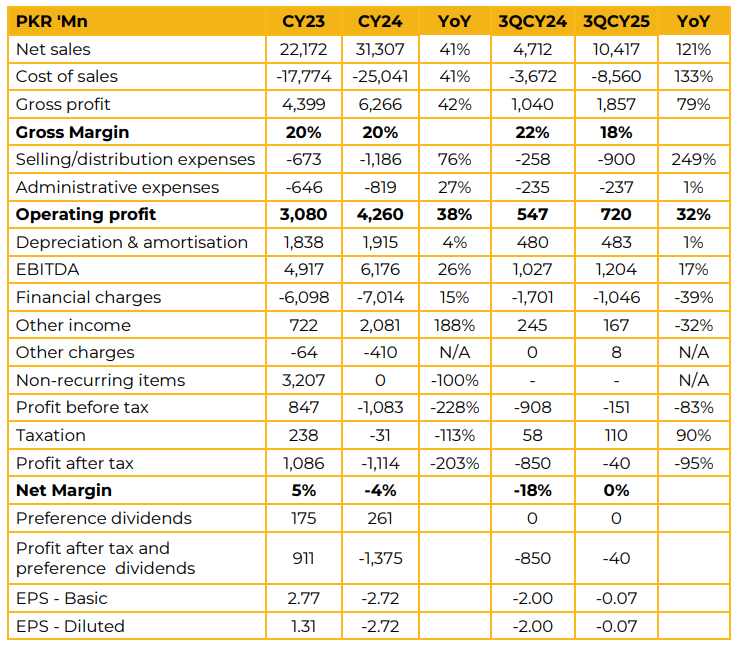

Agritech Limited (AGL) reported loss per share of PKR 2.72 for CY24, compared to earnings per share of PKR 2.77 in CY23. Furthermore, in 3QCY25, the company loss earnings per share of PKR 0.07, compared to loss per share of PKR 2.00 in the same period last year (SPLY).

The company’s production footprint includes a urea manufacturing facility with an installed capacity of 433,000 tonnes per annum and an SSP plant with an annual production capacity of 81,000 tonnes. Management maintains a positive industry outlook, supported by government interventions such as the Kisan Card and Hari Card, alongside improving farm economics. Management expects industry offtake for 2025 to be approximately 6.3 million tonnes.

Looking ahead, offtake for 2026 is expected to be slightly higher than in 2025, reflecting continued improvement in farm economics. On the gas supply front, the company expects to secure permanent gas supply from Mari, although this transition will take time. The pricing framework for Mari gas will be based on Petroleum Policy 2012 (PP-12) along with applicable SNGPL tolling charges.

The modifications and qualifications in the Auditors’ Report were removed in June, which management attributed to consistent gas supply and sustained performance across both top-line and operating profit margins. The government is scheduled to review the broader gas supply and fertilizer situation in mid December. The company has also allocated CAPEX to improve production and energy efficiency at the urea plant, and management noted that an expansion of the SSP plant is also being planned.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose