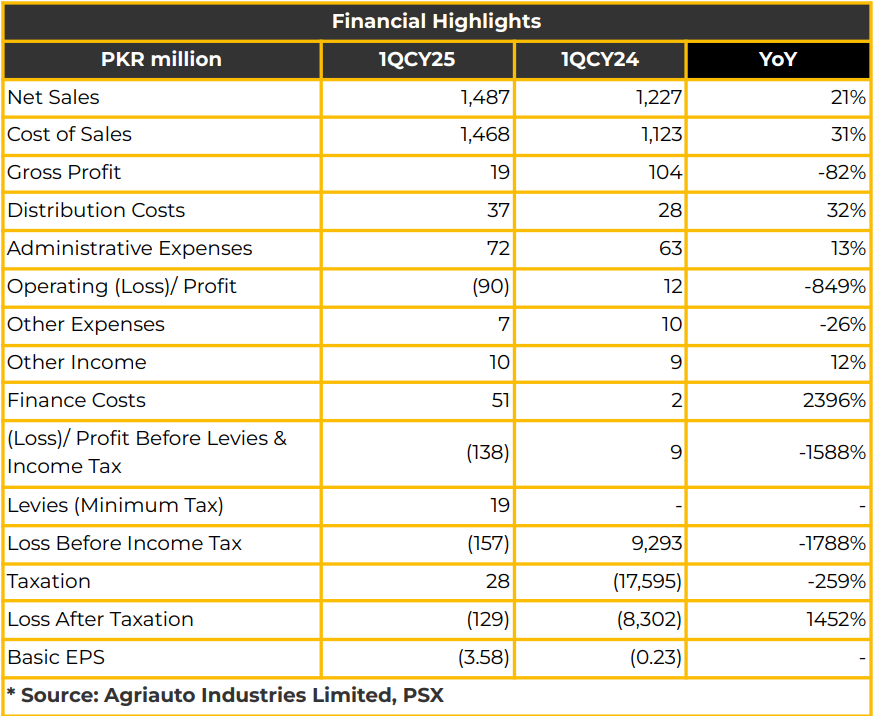

In 1QFY25, Agriauto Industries Limited (AGIL) reported a net loss of PKR 128.85 million (LPS: PKR 3.58), an increase from the net loss of PKR 8.30 million (LPS: PKR 0.23) in the SPLY. The cost of sales rose 31% YoY to PKR 1.47 billion, largely due to an additional PKR 18 million in depreciation.

The consolidated increase in cost of sales also included a PKR 52 million rise in depreciation. In FY24, this rise in depreciation was due to a PKR 2.5 billion investment aimed at expanding the autochrome plant’s capacity, anticipating growth in the auto market.

The expansion also increased financial charges. Management indicated that current order volumes are insufficient to support localization efforts. With exemptions available until June 2026, AGIL anticipates that localization will become feasible only when order volumes increase, estimating a 2-3 year timeline to achieve this. Following an after market size of PKR 829 million in FY24, the current market is at PKR 640 million, with a target of PKR 1 billion.

This increase is attributed to customs control measures restricting imports of under-invoiced and used parts. AGIL’s fixed rupee margins from OEMs have grown by 60-70% this year, driven by increased utility costs. The company recently received an order from Thailand worth USD 50,000 for dies supplies to South Africa, with delivery expected this month. AGIL initiated exports for shock absorbers.

Margins on exports range from 20-25% for passenger cars, though aftermarket margins are around 20% due to competition with importers.

AGIL is also developing new parts, which are expected to boost gross margins to over 30%. Management highlighted that the new entrants in the auto market have impacted the market share of established OEMs, and the industry has contracted by 50% since FY22.

The benefits provided to new entrants have been extended until June 2026. AGIL’s sales mix is composed of 70% passenger cars, 20% motorcycles, and 10% tractors, with Indus Motor purchasing substantial volumes from Procon. Going forward, AGIL management expects demand to increase in FY25 and anticipates improved margins. Additionally, management reported that Suzuki remains unaffected.

However Alto has a significant backlog with positive demand. The Punjab government announced a subsidy scheme for farmers, with Millat receiving orders for 5,852 units, Al-Ghazi for 3,800 units, and ATEC for 152 units. AGIL will supply parts for these orders to MTL and Al-Ghazi Tractors until January.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.