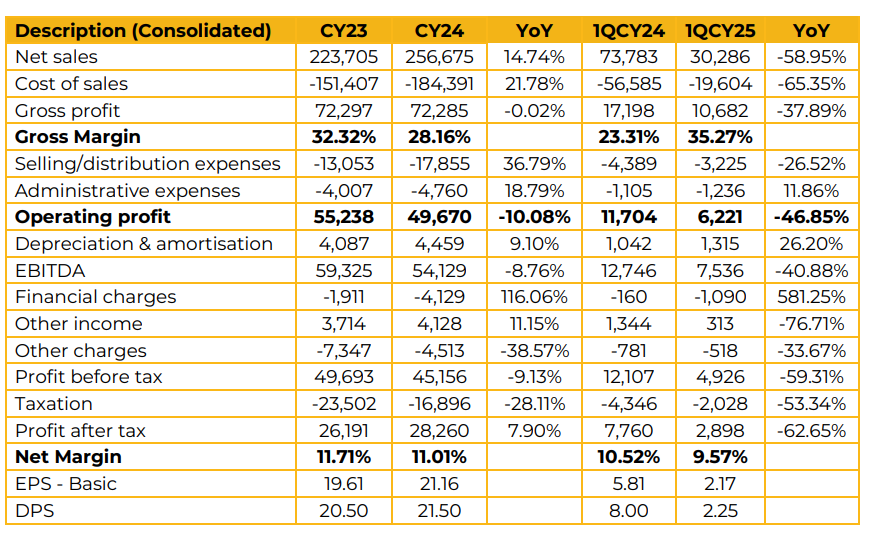

Engro Fertilizers Limited reported earnings per share (EPS) of PKR 21.16 for CY24, compared to PKR 19.61 in CY23, reflecting a year-onyear improvement. However, in 1QCY25, the company posted an EPS of PKR 2.17, significantly lower than PKR 5.81 in the same period last year (SPLY).

Management attributed the earnings decline primarily to a substantial inventory buildup, driven by the altered buying patterns of farmers.

Additionally, the company’s reduced market share was linked to the high cost of its urea product relative to competitors. Addressing concerns about operational activity, the management clarified that there are no plans for an industrial shutdown.

They explained that the inventory pile-up is largely a result of timing differences rather than structural issues. While they had anticipated a slowdown in the current quarter, the actual decline exceeded their expectations. The management expects total industry urea offtake to be in the range of 6.1 to 6.2 million tons.

Regarding the potential for exports, the management noted that urea exports have occurred in the past, but any future exports would require regulatory approval. In response to market dynamics, the company offered targeted discounts during the quarter based on demand-supply conditions.

These discounting measures are expected to continue in the current quarter as well. On the topic of crop switching, management observed that most farmers tend to sow the same crop. They added that it will take some time for the market to adjust to the sharp decline in wheat prices.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.