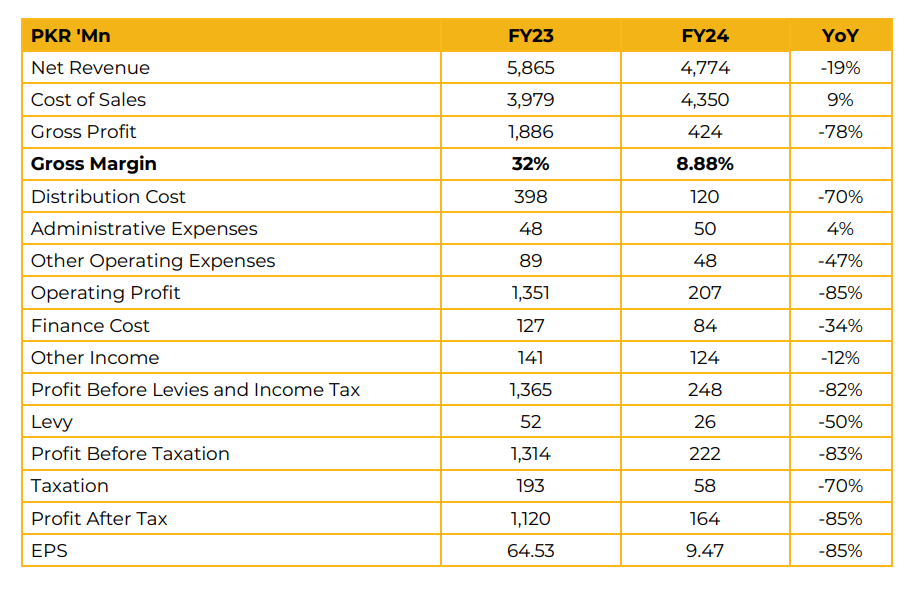

In FY24, Al-Abbas Sugar Mills Limited (AABS) reported a net profit of PKR 164.35 million (EPS: PKR 9.47), reflecting an 85% decline from the previous year’s net profit of PKR 1.12 billion (EPS: PKR 64.53). Sugar production was reported at 50,184 metric tons in FY24 (FY23: 42,175 Metric tons), with a sugar recovery rate of 10.26%, while sugarcane crushed stood at 489,122 metric tons (FY23: 400,820 metric tons).

Ethanol production decreased to 43,771 metric tons from 45,250 metric tons, with a recovery rate of 5.07% compared to 5.16% in the prior year. Molasses consumption also declined to 221,023 metric tons from 233,099 metric tons during the same period. Ethanol profitability was adversely affected last year due to reduced demand caused by GSP+ status, increased competition from local players in exporting markets, higher production costs in Pakistan, and the devaluation of the Pakistani rupee. Management highlighted that molasses supply remains constrained, currently AABS producing only 8-9% of the total requirement, with prices rising to PKR 28,000-30,000 per ton, an increase of PKR 5,000-6,000 per ton. Ethanol prices in the international market have slightly improved, trading at PKR 720-725 per ton.

The small pack market presents a significant opportunity for growth, with AABS producing 50% of its ethanol volume in small packs. Management sees this segment as a competitive advantage, potentially offering a margin edge of USD 2-3. The ethanol ex-mill price is PKR 720 per ton, with a conversion cost of USD 110-120 per ton. Due to unfavorable business conditions, production facilities in the chemical, alloys, and power segments have been temporarily suspended. The power plant has a generation capacity of 15 MW, and resumption of operations will depend on an improvement in market conditions. Looking forward, management anticipates a challenging year ahead.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.