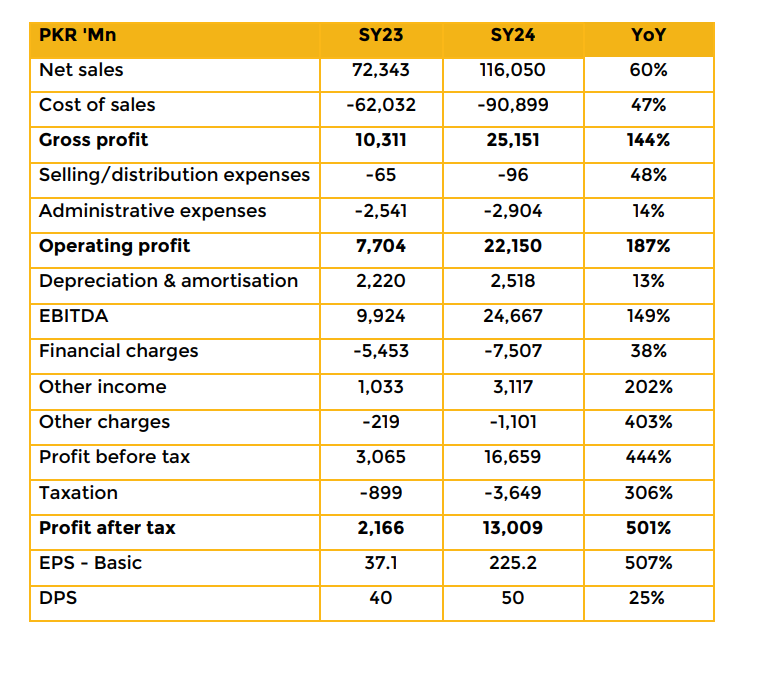

JDW Sugar Mills Limited achieved earnings per share (EPS) of PKR 225.2 in SY24, marking a substantial increase compared to PKR 37.1 in SY23. In 9MSY24, the company reported an EPS of PKR 144.9, a significant improvement from PKR 25.3 recorded during the same period last year (SPLY).

The company’s corporate farms contribute 7-10% of the group’s total annual sugarcane requirement. JDW has initiated the development of a distillery plant to produce ethanol. The facility, with a production capacity of 230,000 litres per day, is scheduled to become operational in the second quarter of the year.

Management expects a marginal improvement in sucrose recovery compared to the previous year. The sucrose recovery rate in the preceding year was recorded at 10.45%. Additionally, sugar prices are projected to remain favourable. The distillery plant was constructed at a cost of approximately PKR 12-13 billion, with an anticipated payback period of 4-5 years.

Management intends to export 96-97% of the ethanol production, with the remainder to be either utilized domestically or exported as needed. For the current year, JDW anticipates sugar production to adequately meet domestic demand, eliminating the likelihood of surplus. The government’s production target for this year is 6.6 million tons, while JDW projects production of approximately 6.2 million tons. The shortfall is expected to be offset by last year’s surplus.

To ensure farmers receive equitable compensation and are encouraged to sustain sugarcane cultivation, JDW is procuring sugarcane at PKR 400 per 40 kilograms. This marks a reduction from the previous year’s price of PKR 435 per 40 kilograms. The lower procurement cost is expected to positively impact profitability.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.