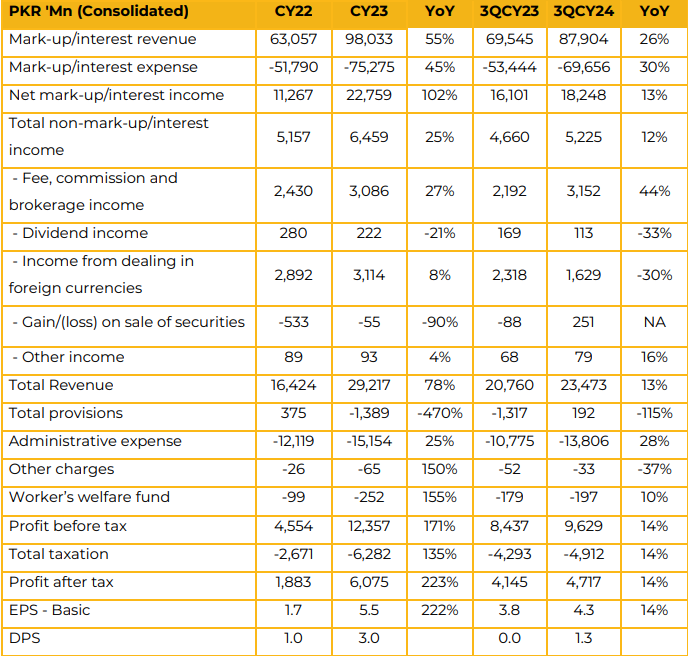

Soneri Bank Limited reported earnings per share of PKR 5.5 in CY23 against an earnings per share of PKR 1.7 in CY22. Furthermore, in 3QCY24 the company reported earnings per share of PKR 4.3 against PKR 3.8 in SPLY.

Company Net Interest Income stand at PKR 18,248 million in 3QCY24 against PKR 16,101 million in SPLY depicting an increase of 13%. The bank’s capital adequacy ratio currently stands at 18.6%. Discussions are ongoing between the bank, regulatory authorities, and government-appointed bodies regarding ADR.

Regardless of the outcome, the bank is confident it can achieve the 50% ADR limit. Presently, their ADR ranges between 40% and 50%. Till date, the bank has expanded its branch network by adding 97 new branches, bringing the total to 540 branches. Over the past year, the bank introduced several innovative offerings, including a platinum debit Mastercard, enhanced mobile banking services, and the acquisition of point-of-sale (POS) systems to facilitate its customers.

Additionally, the bank has launched priority banking services for high-net-worth individuals. Banks current accounts comprise 33% and savings accounts represent 49% of the bank’s total deposits, reflecting year-on-year growth of 22% and 14%, respectively. The bank’s investment portfolio is heavily weighted towards Pakistan Investment Bonds (PIBs) at floating rates, accounting for 49% of the total portfolio.

Treasury Bills (T-Bills) make up 35% of the portfolio. They further added that the bank aims to convert 31% of its branches to Islamic banking windows by the end of 2025.

Looking ahead, the bank plans to add 126 new branches to its network by 2025. This expansion strategy is expected to enhance visibility, attract higher deposits, and support continued growth. The bank remains optimistic about maintaining profitability, supported by increased branch presence and a higher proportion of current deposits relative to total deposits.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.