Key Takeaways:

• Declining interest rates to reap positive benefits in subsequent quarters.

• Management mentioned sales target of PKR 1 billion by the end of FY25.

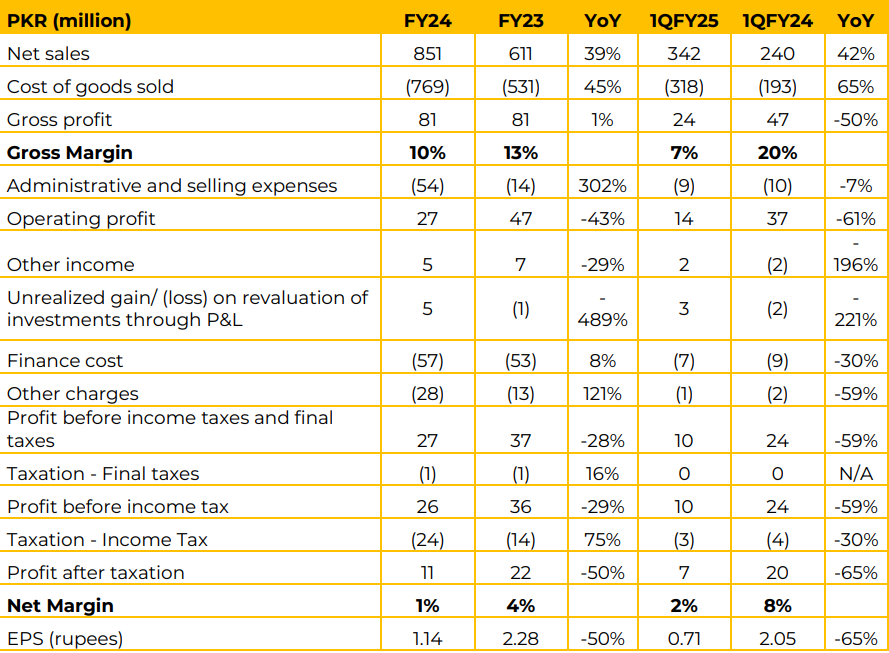

International Knitwear Limited (IKL) reported a significant increase in net sales, growing by 39% YoY in FY24 to PKR 851 million. In 1QFY25, sales surged by 42% YoY to PKR 342 million

Gross profit remained flat at PKR 81 million for FY24 despite higher sales, with the gross margin contracting from 13% to 10% YoY, due to higher input costs. For 1QFY25, gross profit dropped 50% YoY to PKR 24 million, and the margin fell sharply to 7% from 20%. The company had to ship an export order by air, to uphold commitment with an export buyer costing PKR 14 million, adversely impacting the gross margin in 1QFY25.

Finance costs increased moderately by 8% YoY to PKR 57 million in FY24, reflecting higher borrowing costs. In 1QFY25, however, finance costs fell by 30% YoY to PKR 7 million. Further reduction in finance cost is anticipated going forward.

The company is expanding its solar capacity from 125 KW to 250 KW. The increased capacity will cater 70% of the electricity requirement. The project is expected to be completed by the end of FY25.

Looking ahead, the management expects further reduction in finance cost. The company is also targeting sales of PKR 1 billion by the end of FY25. The company is also working to achieve net profit margin of 4-5% going forward.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.