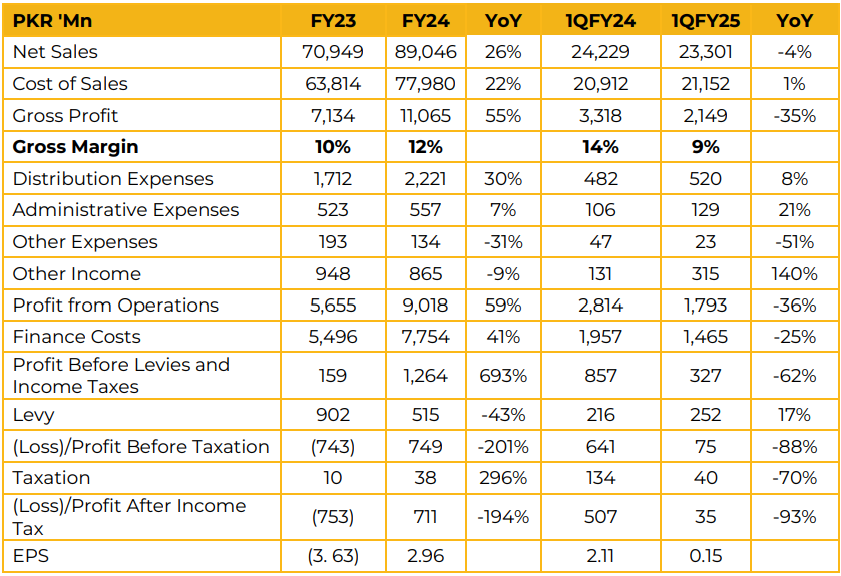

Nishat Chunian Limited (NCL) reported a net profit of PKR 710.70 million (EPS: PKR 2.96) in FY24, a significant turnaround from a net loss of PKR 752.63 million (LPS: PKR 3.63) in FY23. Revenue for FY24 increased by 26% year-on-year to PKR 89.05 billion, compared to PKR 70.95 billion in FY23.

The company derived 57% of its revenue from the local market and 43% from exports. Spinning contributed 62% to total sales, processing and home textile 25%, weaving 13%, and power generation 0.04%. NCL’s return on equity (ROE) was reported at 3.23% in FY24.

The spinning segment recorded PKR 55.1 billion in sales, with a 32.67% growth in yarn sales, including a 28.70% increase in yarn exports. Spinning sales in the local market were PKR 39.3 billion, while export sales stood at PKR 15.8 billion. Weaving sales increased to PKR 11.45 billion, and home textile sales grew to PKR 22.29 billion, driven by a 91.33% increase in exports.

Gross margins improved due to the availability of cotton at favorable prices, despite higher input costs. Management plans to expand spinning production capacity and install new machinery, including a sizing machine in the weaving division. The company has recently launched a showroom in New York to facilitate product trading. NCL reported annual cotton consumption of 200,000 to 250,000 bales and maintains an inventory of imported cotton sufficient to last until the mid of next year.

The fuel mix predominantly comprises local and imported coal. Annual electricity consumption was reported at 360 million units. The company operates a biomass generator with a capacity of 24 tons per hour and a total power generation capacity of 46MW. A solar plant has been installed at the dyeing zone III, effectively reducing costs. The company is also evaluating the winter package proposed by the government.

NCL operates eight retail outlets in Pakistan and one in Sharjah. Management aims to expand the retail footprint by introducing new outlets and broadening product ranges.

Going forward, NCL plans to redirect yarn sales to Turkey and other South Asian countries, as well as expand its domestic market share due to the inability to sell to China. The company remains focused on leveraging biomass energy to enhance operational efficiency. The company has set a revenue target of PKR 100 billion for FY25, contingent on political and economic stability.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.