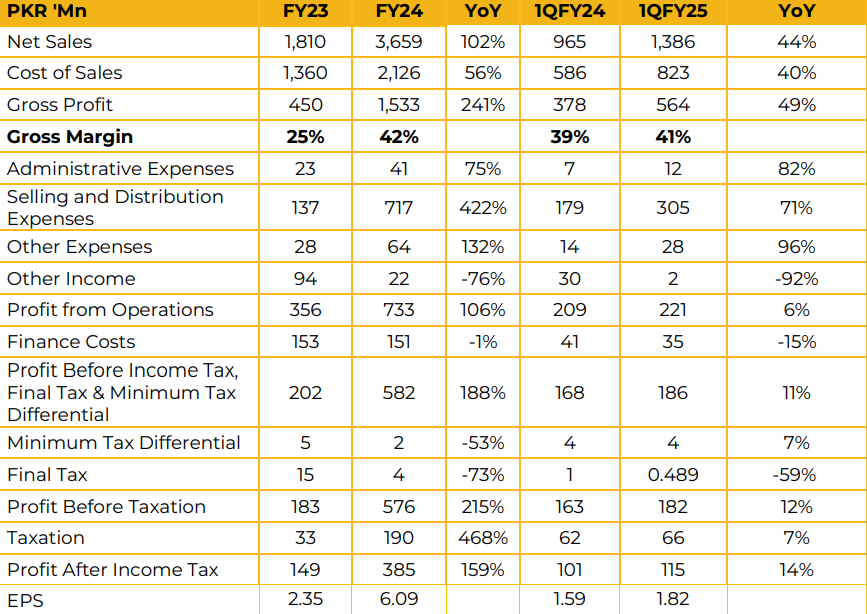

BF BioSciences Limited posted a net profit of PKR 385.41 million (EPS: PKR 6.09) in FY24, a significant increase compared to a net profit of PKR 149.05 million (EPS: PKR 2.35) in FY23. Revenue for FY24 stood at PKR 3.66 billion, reflecting a robust 102% YoY growth compared to PKR 1.81 billion in FY23.

Management attributed 18% of the revenue growth to price increases.

The company reported that Line II is currently in the validation phase, with 90% of the required materials having reached the facility. The capacity of Line II is outlined as follows:

• Liquid (2ML): 192,000 units daily

• Liquid (30ML): 50,000 units daily

• Lyophilizer (2ML): 200,000 units daily

• Lyophilizer (30ML): 50,000 units daily

• Pre-filled syringes (0.5ML): 50,000 units daily

Management highlighted that the global pharmaceutical industry is expected to reach USD 2.83 trillion by 2033, with a projected CAGR of 6.15%.

The company launched Sematide in the final month of 1QFY25, contributing 7% to the topline. Management plans to introduce the Sematide pen, projecting its contribution to topline to be around PKR 500-700 million. As a patentprotected product (expiring mid-2026), Sematide is targeted for exports to unregulated markets. Margins for Sematide are expected to range between 40-50%.

However, the product is not anticipated to fully replace insulin but rather complement oral medications. BF BioSciences also plans to launch Monjoro and Lilly products in this category. The market size of the GLP-1 segment is reported to be approximately PKR 3 billion.

Management stated that the government is allocating resources to eliminate Hepatitis C in Pakistan by either 2023 or 2035. The essential and non-essential products accouns for a 70:30 ratio.

Looking ahead, the company intends to focus on the cardiovascular, metabolic, and obesity segments. The gross profit margin outlook is projected at 37-39%.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose