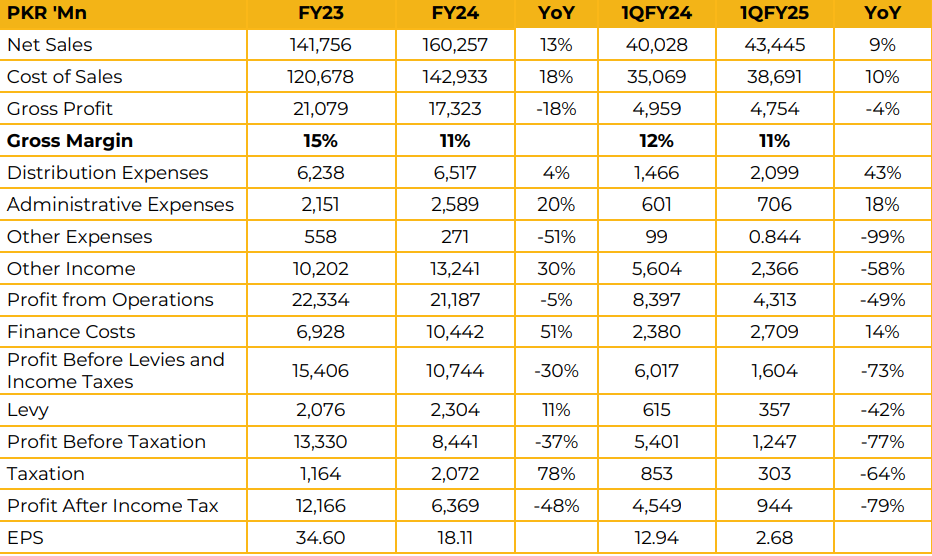

Nishat Mills Limited (NML) reported a net profit of PKR 6.37 billion (EPS: PKR 18.11) in FY24, reflecting a 48% decline compared to PKR 12.17 billion (EPS: PKR 34.60) in FY23. Revenue for FY24 stood at PKR 160.26 billion, representing a 13% year-on-year increase from PKR 141.76 billion in FY23.

Management attributed the decline in gross margins to sluggish global demand for textile products and elevated input costs in Pakistan. The market-wise sales breakup for FY24 shows that 25% of sales came from Europe, 20% from Asia, 22% from direct sales to exporters in Pakistan, 14% from America, and 19% from the domestic market in Pakistan. The product-wise sales breakup reveals that yarn accounted for 27% of sales, greige cloth 20%, processed cloth 20%, made-ups 16%, towels and bathrobes 7%, and garments 10%. NML enhanced its equity investment in Nishat Sutas Dairy Limited from PKR 3 billion to PKR 5 billion.

The company expanded its denim and workwear units to drive sales in value-added segments, with capital expenditures for the denim unit reported at PKR 12 billion and PKR 3 billion for the workwear unit. The total production capacity for denim is stated as 1.4 million meters.

A wholly owned subsidiary was established in Turkey along with a liaison office in Bangladesh. Additionally, the sale of Nishat Hospitality (Pvt) Limited to Nishat Hotels & Properties Limited, valued at PKR 1.7 billion, is underway to create operational synergies. Management also highlighted a scheme of arrangement involving Nishat (Chunian) Limited, Nishat Chunian Power Limited, and two key shareholders.

Management noted that the winter package would not impact operations as the company relies on alternative fuels. The average electricity cost was reported at PKR 30-32 per kWh. The company holds an order book for cotton through June 30, 2025. NML’s installed power generation capacity is 161MW, including 20MW from solar, which is expected to increase to 33MW within a month following the completion of three solar projects in the spinning division.

Nishat Linen repaid a loan of PKR 8 billion during FY24. Regarding Hyundai Nishat, management indicated plans to enter the EV market after further clarity on the government’s EV policy and positive market feedback.

Looking ahead, management anticipates continued challenges, including soft demand in export markets, elevated input costs, expensive bank financing, and high taxation. The company’s strategy is to focus on increasing sales of value-added products to drive growth and internationalize the business

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose