Key Takeaways:

• Local blending of lubricants to enhance margins and volumes.

• Exports to be focused on with foreign partner providing distribution network in 16 countries

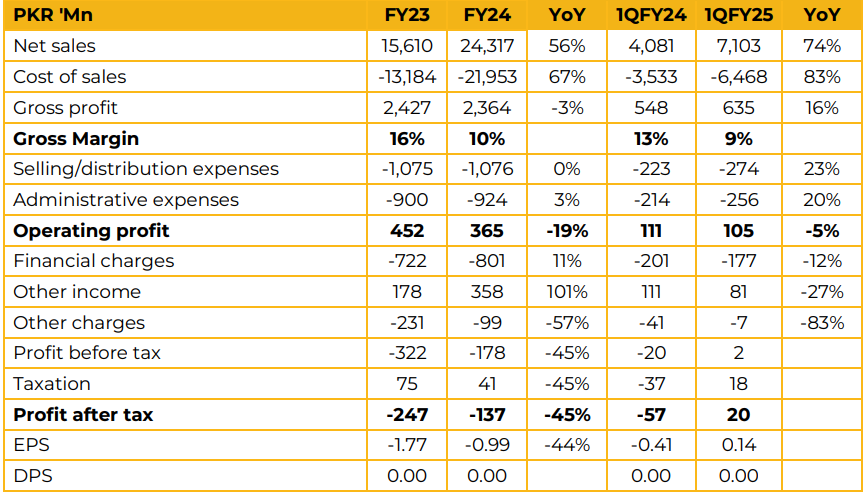

Hi-Tech Lubricants Limited reported loss per share of PKR 0.99 in FY24 against loss per share of PKR 1.77 in FY23. Total revenue in FY24 reached PKR 24.3 Bn against PKR 15.6 Bn in FY23, an increase of 56%. The company saw its gross margin decrease from 16% in FY23 to 10% in FY24.

This was due to reduced pricing power in the market. In its polymer division, the company is currently providing plastic products to 80-90% of the Punjab pharmaceuticals industry. Along with this it has also secured an order from Pakistan Tobacco Company Limited as well as electronics companies. The management looks forward to increased profitability in its lubricants segment where previously they had to bear 26% duty on imports.

With the introduction of local blending it will only pay 12% duty on raw materials. Gross margins in this segment are expected to reach 40-45% after local blending begins in the next few weeks. It is expected that initially 70% of products will be made in this project with a target to achieve 99% by June 2025.

Given the duty benefit of local blending the management expects to be price competitive and expects 30-35% volumetric growth.

Currently the company holds 45% share in the synthetic lubricant market. It holds 1% of the non-synthetic market and management sees this as a growth opportunity. To capitalize on this, it plans to double its network size to be able to reach customers.

Additionally, the company will begin exporting to other countries in the near future. Its foreign partner SK Enmove has provided it with a list of 16 countries where it would like products to be exported to its distributors. The company will collect payment from SK Enmove directly for these orders.

The expected gross margin on these sales is 10-15%. HTL does not plan on increasing its leverage and hopes to continue its dividend policy once it returns to consistent profitability. With regards to the fuel business, it was highlighted that while it is not profitable yet it is hoped this will be achieved soon.

Further expansion in this segment will also be funded through the sale of dead properties and remaining funds of PKR 200 Mn from the IPO. Fuel itself is sourced on credit from suppliers and therefore the company does not anticipate need for cash. Going forward, the management expects huge growth potential in its lubricants segment to drive profitability.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.