Key Takeaways:

• Price increases and cost cutting contributing to expanding margins.

• Sales increasing with trajectory looking good

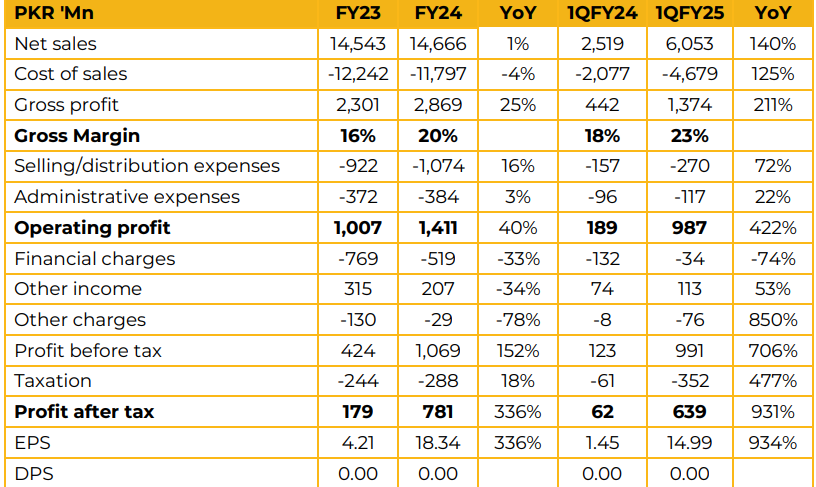

Ghandhara Industries Limited reported earnings per share of PKR 18.34 in FY24 against earnings per share of PKR 4.21 in FY23 an increase of 336%. Total revenue in FY24 reached PKR 14.7 Bn against PKR 14.5 Bn in FY23, an increase of 1%. The company saw its gross margin increase from 16% in FY23 to 20% in FY24.

The company saw its margin further expand to 23% in 1QFY25 on the back of price increases where possible and cost cutting measures. The most popular product is the F series prime mover which ranges from PKR 13-38 Mn in price. There is no anticipated dividend policy at this time as the management believes it makes more sense for the company to consolidate after the difficult times it has gone through.

Sales have been driven in recent months by axle load restrictions, Reko Diq project and dam related construction. The management clarified that while Reko Diq has not started yet contractors working to secure contracts and those who have been awarded preliminary work have been securing trucks.

The company is able to charge a premium for its product as it is a Japanese truck and through marketing efforts as well as their flexible and customer centric approach. Going forward, the management is hopeful of continued sales volume with sustained margins.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.