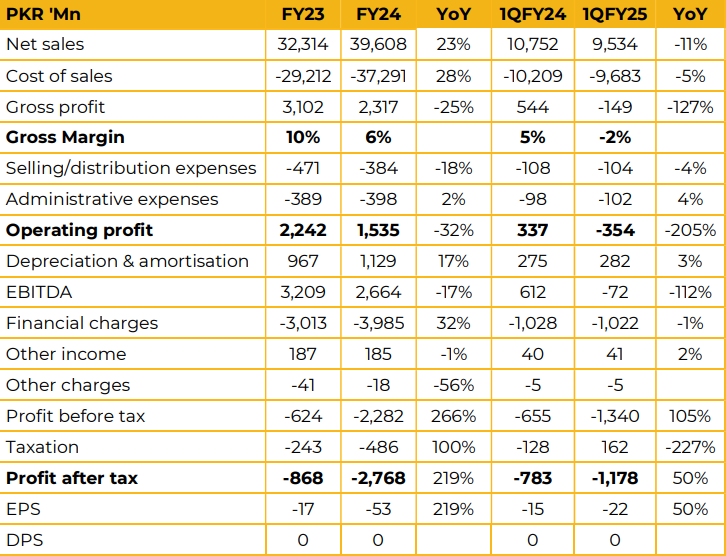

Din Textile Mills Limited reported a loss per share of PKR 53 for FY24, compared to PKR 17 per share in FY23, reflecting a 219% increase in losses. Furthermore, in 1QFY25 the company has reported loss per share of PKR 22 against loss per share of PKR 15 in SPLY.

The company operates four spinning units with a total of 136,656 spindles. Despite challenges, sales revenue grew by 23%, increasing from PKR 32.31 billion in FY23 to PKR 39.61 billion in FY24. However, the loss after tax surged by 219.13%, rising from PKR 0.87 billion in FY23 to PKR 2.77 billion in FY24.

The primary drivers of these substantial losses were high raw material costs, a cotton shortage, and rising finance expenses. The company has not paid any dividends since 2019 due to its ongoing expansion phase and weak earnings, resulting in a 0% dividend payout over the past four to five years.

Total assets decreased by 8.57%, reflecting a decline linked to the company’s major expansion efforts. Key challenges faced by the company include escalating energy costs, a shortage of cotton (with production falling from an expected 8.5 million bales to just 4-5 million due to low yields and quality issues). further crop damage is expected in upcoming season caused by heavy rains, which led to excessive moisture and lower quality. In response, the company is planning to import cotton to maintain production levels.

However, Din Textile anticipates a reduction in its net loss by PKR 1.5 billion due to a decline in finance costs. The company also expects a positive impact from lower natural gas prices, as it relies heavily on gas.

In addition, the company has been working on integrating solar energy into its operations for the past 1 to 1.5 years, with 10% of its power currently sourced from solar panels. It is focusing on further increasing solar reliance, especially if gas price cuts materialize in the coming months.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.