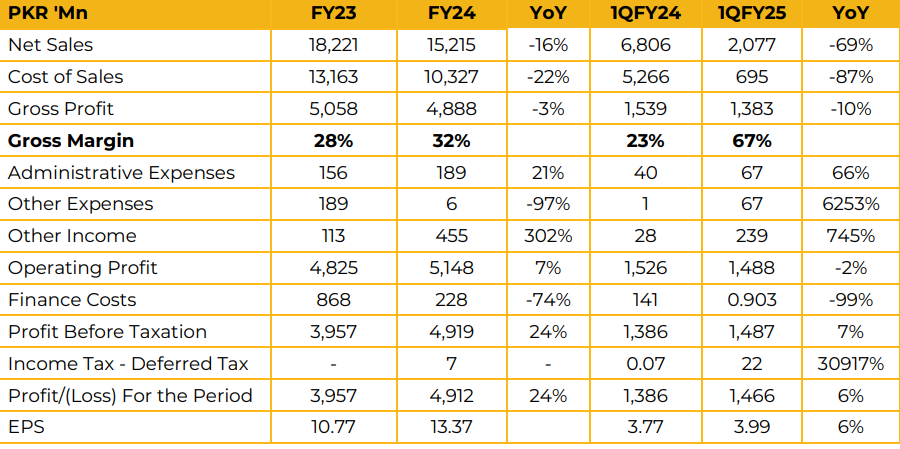

Nishat Chunian Power Limited (NCPL) reported a net profit of PKR 4.91 billion (EPS: PKR 13.37) in FY24, compared to PKR 3.96 billion (EPS: PKR 10.77) in the same period last year (SPLY). Revenue for FY24 stood at PKR 15.22 billion, reflecting a 16% YoY decline compared to PKR 18.22 billion in FY23. NCPL incurred a penal interest of PKR 1.56 billion on receivables.

The management stated that the dispute regarding PKR 8.3 billion in trade debts is expected to be resolved soon, either by the end of this month or early next month, with no anticipated cashflow impact.

The lower dividend payout was attributed to market uncertainty and the company’s strategy to retain funds for uncertain times. The breakdown of trade receivables was reported as follows: PKR 5.5 billion in EP, PKR 2.7 billion in CP, and PKR 1.7 billion in TP.

The company possesses engines suitable for peaking power and may target industrial areas if it enters a competitive market, contingent on a government shift to a “take-andpay” model. In the first round of negotiations, the government concluded contract terminations with five companies. In the second round, discussions are ongoing with 18 companies, with some already reaching agreements. Management anticipates a sustained dividend payout subject to board approval. Additionally, the government is developing a hybrid model for the power sector.

The Independent Power Producers (IPPs) have no termination of contract as an option. Management aims to reach an agreement with minimal impact on profitability.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.