Key Takeaways:

• Steep drop in SBP policy rate to drive finance costs savings this year.

• Expected construction package to boost demand for long steel in the domestic market.

• Copper demand expected to remain robust in the long term.

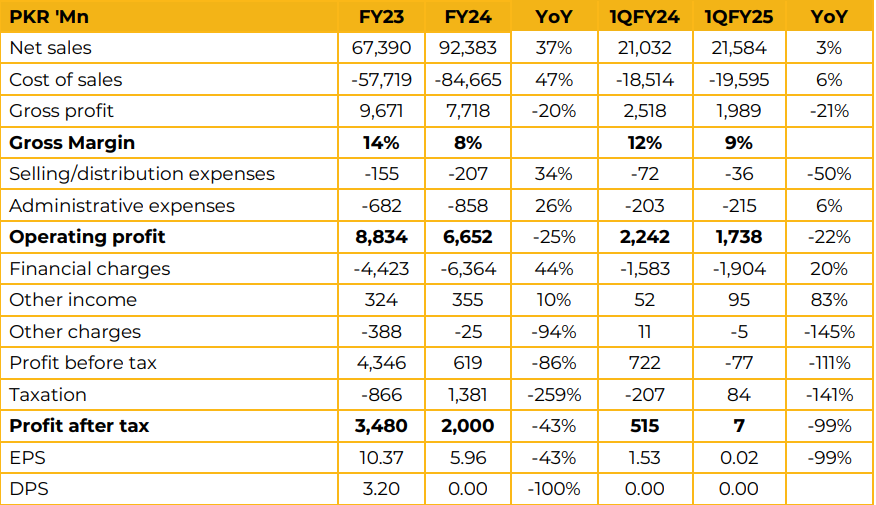

Mughal Iron & Steel Industries Limited reported earnings per share of PKR 5.96 in FY24 against PKR 10.37 in FY23, a decrease of 43%. Revenue for FY24 was recorded at PKR 92.4 Bn, up 37% from PKR 67.4 Bn in FY23. The company saw a gross margin of 8% in FY24 down from 14% in FY23.

It is expected that these margins will recover once demand in the domestic market picks up. Management apprised that MUGHAL is the only company in its sector which boasts shorter lead times of 40-50 days compared to the 60-90 days lead time other players need for sourcing iron scrap.

It was highlighted that the company’s products are available all over the country through its comprehensive distribution network. Over the past few years despite depressed demand in the ferrous segment the company has retained its marker share and hopes to benefit from resurgence in demand once economic growth speeds up.

The company experienced an average finance cost of 23-24% in FY24 which it expects will fall to 15-16% this year leading to significant savings thereby boosting profitability. Management highlighted that in the non-ferrous segment prices of copper have fallen from USD 10,500 to 9,500 in recent months however this has not had an impact as raw material prices have also moved in tandem.

The management pointed out that while export of copper is lucrative it is not easy to scale it fast as there are constraints in procuring raw material of the required quality. It was also shared that a construction package is on the cards for the domestic market and as such management is prepared for resurgence in demand.

The company is also moving its production of small and medium sections to its tandem mill which will come online at the start of FY26. It is expected to cause a drop in gas usage from 90 cubic meters per ton to 25-30 cubic meters per ton in this segment.

The company exported 8,700 tons of copper last year and hopes to maintain this level for this year with a maximum growth of 10-20%. The management pointed out that it was not feasible to acquire a sugar mill and use its power facilities to set up a new plant as the power requirement for steel production is too high. On the other hand, it was also pointed out that the company’s competitive advantage stems from its vertically integrated production which can change its output.

Mughal Energy is expected to be commissioned in the first quarter of next fiscal year. It was highlighted that it will become the primary source of power once online with efficiency of 35%. Going forward, the management was hopeful of easing finance costs and the gradual resumption of demand growth. However, prospects for faster growth do not seem present in the near future.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.