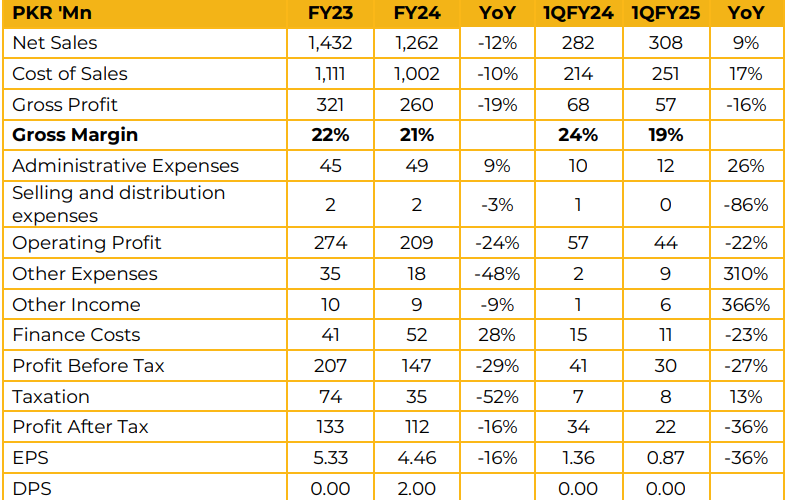

Safe Mix Concrete Limited reported earnings per share of PKR 4.46 in FY24 against PKR 5.33 in FY23, a decrease of 16%. The company reported revenue of PKR 1.26 Bn in FY24 against PKR 1.43 Bn in FY23 showing a drop of 12%. Gross margin for FY24 clocked in at 21% down from 22% in FY23.

The management shared that it is expected that the government will be announcing a construction package soon. No further details were provided on this. It was also clarified that the reason for low capacity utilization of their batching plant was due to bottlenecks with regards to transit mixers and pumps to deliver the concrete at client’s sites.

The plant is capable of supplying to projects within a 25 km radius of it and as such the management has taken on multiple large clients in the area including Saima Builders, OK Builders, Javedan, Globe Residency and Rahat Residency.

It was also clarified that the reason for not targeting all projects of any one developer is to avoid concentration risk. The management also shared its outlook for the future where it expects that over the next 5 years it will reach earnings per share of PKR 5.83. This represents a CAGR of 5.5% till FY29.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.