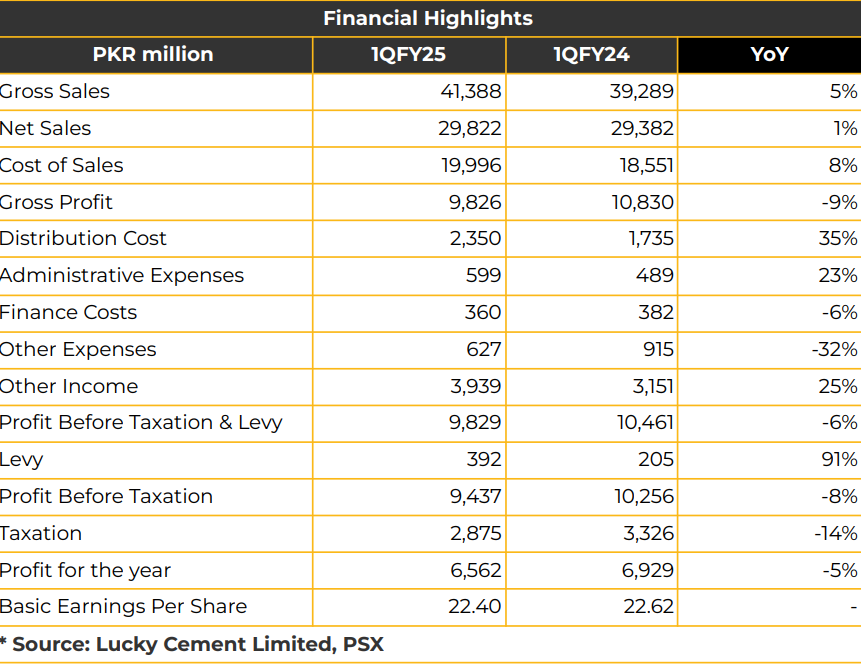

In 1QFY25, Lucky Cement Limited (LUCK) reported a net profit of PKR 6.56 billion (EPS: PKR 22.40), a 5% YoY decline from PKR 6.93 billion (EPS: PKR 22.62) in the SPLY, attributed to higher inflation and reduced consumer purchasing power. Gross sales increased 5% YoY to PKR 41.39 billion in 1QFY25, up from PKR 39.29 billion, driven primarily by export sales growth.

Volumetric dispatches rose by 1.8%, with increased exports in 1QFY25. Pre-tax operating profit was impacted by 20%, reaching PKR 6.9 billion during the period. Other income rose, mainly due to PKR 1.7 billion dividend from LCI and PKR 0.3 million from YEL, as well as interest income on surplus funds. Management is accumulating cash for contingency and growth opportunities.

Export dispatches surged by 117% YoY in 1QFY25 to 0.8MT. Falling coal prices improved the feasibility of cement exports, enhancing margins. Export market share rose significantly to 38.1% in 1QFY25 from 21.5% in the SPLY. Management reported strong foreign cement operations performance due to healthy margins, demand, and above 90% capacity utilization.

Domestic cement sales dropped by 22.6% to 1.4MT, with market share at 16.9%, down from 17.5% in the SPLY. Local sales volumes fell 15% YoY due to lower domestic demand, aligning with industry trends. A new plant launch captured additional markets, though overall market share declined.

Management attributed the drop in local demand to higher inflation, elevated interest rates, and lower consumer purchasing power. Additionally, increased gas prices pushed up the average selling price of cement, impacting dispatch volumes.

Consolidated revenue rose 7.3% to PKR 111.6 billion in 1QFY25, up from PKR 104.1 billion in the SPLY. EBITDA decreased by 1.8% to PKR 29.7 billion during the period. Consolidated net profit rose 2.3%, reaching PKR 19.8 billion (EPS: PKR 61.2). LUCK reported receivables equivalent to five months of invoicing. The South and North plants operated using a mix of imported and local coal, with an average coal cost of PKR 38,000 per ton in 1QFY25.

Average retention prices remained stable at PKR 15,000 to 16,000. The investment in National Resources (Private) Limited (NRL) is currently in an exploratory phase, with LUCK evaluating potential investment avenues. A 28.8 MW wind power project completed commissioning in 1QFY25, raising total capacity to 100MW. Following the solar and wind power project completions, renewable sources now account for 55% of LUCK’s total energy needs.

Management indicated no plans to expand domestic cement operations within the next few years. The recent decrease in Afghan coal prices is expected to take effect within a couple of weeks, with a projected PKR 5,000–6,000 reduction after a lag period. LEPCL reported successful operations with 100% plant availability.

Going forward, LUCK anticipates growth in the mobile segment and expects normalized imports post-GST adjustment. Cement demand is likely to improve with easing inflation and interest rates. Management plans to reduce costs through renewable energy investments and efficiency improvements. In the chemical segment, LUCK will focus on diversifying its portfolio while managing costs effectively. LMC will emphasize optimized operations and localization to minimize reliance on imported components. The mobile sector outlook is positive, with potential for low-cost smartphones. Management anticipates cost savings on electricity supply with Thar coal starting next year.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.