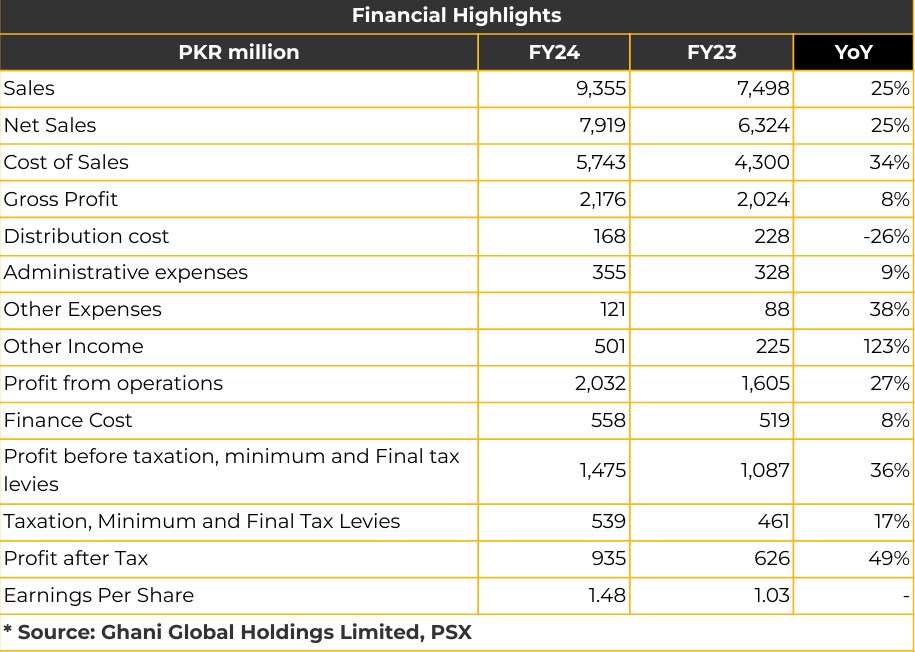

In FY24, Ghani Global Holdings Limited (GGL) reported a net profit of PKR 935.12 million (EPS: PKR 1.48), marking a 49% YoY increase from PKR 625.99 million (EPS: PKR 1.03) in the previous year. Net sales grew by 25% YoY to PKR7.92 billion, compared to PKR 6.32 billion in FY23. Gross profit rose 8% YoY to PKR 2.18 billion, while the cost of sales surged 34% YoY to PKR 5.74 billion. The company’s finance cost increased 8% YoY to PKR 557.81 million, compared to PKR 518.83 million in the SPLY. Current assets stood at PKR 356 million (FY23: PKR 221 million), while current liabilities were reported at PKR 127 million (FY23: PKR 16 million) in FY24. GGL holds two key subsidiaries: Ghani Chemical Industries (GCIL) with a 55.96% shareholding, and Ghani Global Glass Limited (GGGL) with a 50.10% share holding. GCIL recorded a net profit of PKR 786 million (EPS: PKR 1.58) in FY24, reflecting a 55% YoY increase from PKR 508 million (EPS: PKR 1.06) in the SPLY. Turnover surged 25% YoY to PKR 6.39 billion, compared to PKR 5.11 billion in FY23. Gross profit rose 10% YoY to PKR 1.61 billion, while operating profit increased 28% YoY to PKR 1.67 billion. GCIL is progressing with the establishment of an import-substitute, limestone-based Calcium Carbide Manufacturing Project. The Hattar Plant is expected to have a production capacity of 275 tons per day. GCIL maintains long-term contracts with major clients such as EPCL, Lotte Pakistan, and ARL. Meanwhile, GGGL reported a net profit of PKR 144.82 million (EPS: PKR 0.60) in FY24, a 42% increase from PKR 101.88 million (EPS: PKR 0.42) in the previous year. Management revealed that GGGL holds a dominant 70% market share in the Chinese glass tube market, with a 15-20% share in Europe. To expand production capacity, GGGL plans to import six state-of-the-art ampoule machines from Europe, which will boost monthly ampoule production from 40 million to 55 million units and increase market share to 25%. To strengthen its export presence, GGGL is in negotiations with consumers in the MENA region, Africa, Latin America, and South Asia. Going forward, management has disclosed that the Calcium Carbide Manufacturing Project will commence operations (CoD) in January 2025, with a production capacity of 76 tons per day. The capex for this project is estimated at PKR 400 million. Furthermore, GGL plans to list Ghani Chemworld Limited, a subsidiary of GCIL, on the Pakistan Stock Exchange

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking

relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose