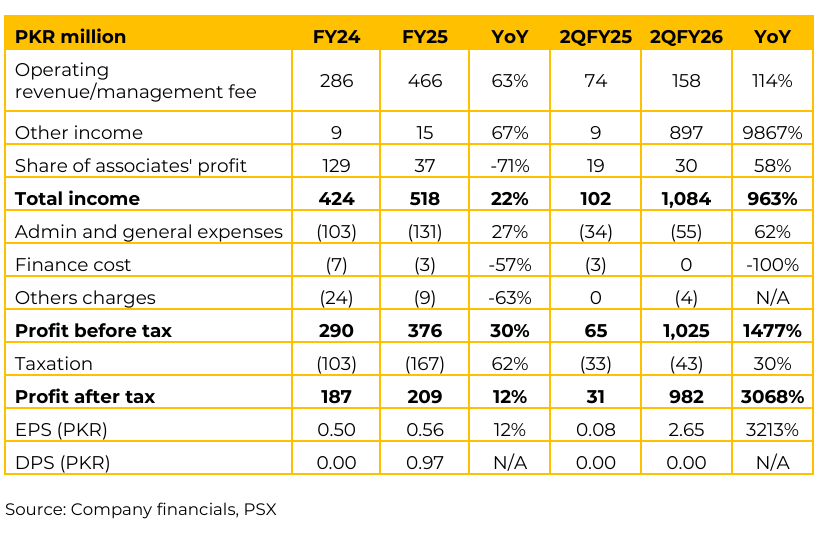

LSEVL has posted earnings per share of PKR 0.56 in FY25 (FY24: PKR 0.50). Moreover, in 2QFY26 the company marked an EPS of PKR 2.65 (2QFY25: PKR 0.08). The recent surge in profitability is largely driven by other income, which a non-cash book entry reflecting market price fluctuations of holdings like PACRA.

A consistent 10% dividend is maintained, with potential to increase to 15–20% following successful IPOs of PGPL & LSE Spac in the coming months.

LSEVL is a successor company to the Lahore Stock Exchange, now positioned as a premier Investment Holding Company and a Corporate Restructuring Company (CRC). LSEVL has recently acquired a Corporate Restructuring Company license, making it one of only three entities in Pakistan and the only listed one to hold this status.

The license allows the company to acquire distressed assets from banks and transfer them without lengthy court processes Management estimates there are roughly 100 non-compliant or defaulting companies on the PSX. LSEVL’s goal is to revive these entities to increase the “supply side” of the market The company’s valuation is driven by its stakes in critical financial infrastructure and energy.

NCCPL (~24% stake): A significant dividend contributor. Dividend income rose from PKR 140 million last year to an expected PKR 170–200 million this year, driven by high trading volumes and the settlement of government Ijarah Sukuks through the NCCPL platform.

CDC Pakistan (10% stake): Valued at an enterprise value of approximately PKR 25 billion. Management expects a potential IPO of CDC (where PSX holds 40%), which could see its value rise to PKR 40 billion (USD 100–150 million).

PACRA (24M shares): Currently trading around PKR 35–36, giving the holding a market value of roughly PKR 900 million. Pakistan Gas Port (PGPL): LSEVL holds 33% Preferred Shares with a conversion option at PKR 50/share.

PGPL operates the country’s largest LNG terminal with a replacement cost of $400M million. An IPO is expected before June, which will serve as an exit for LSEVL as they convert preference shares to common equity.

JJVL: A group company and Pakistan’s largest private LPG producer. Currently operating at 50% capacity (110 mmcfd) due to gas availability, with a target of 200 mmcfd. A listing is planned by December once revenue streams stabilize. LSEVL is delaying the disposal of unlisted stakes to avoid a 50% tax rate.

By waiting for these companies to list, the tax on disposal drops to 12.5%. Going forward, the company has set the IPO completion target for LSE Spac Limited of March 31st.

This is a solar energy joint venture between a Chinese firm and a local company. LSEVL is in the process of disposing of its stake in Digital Custodian Company (DCCL) to resolve regulatory conflicts, as they are also shareholders in its competitor, CDC. The group is considering merging JJVL into LSE Financial Services or using it to acquire a glass manufacturing company.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.