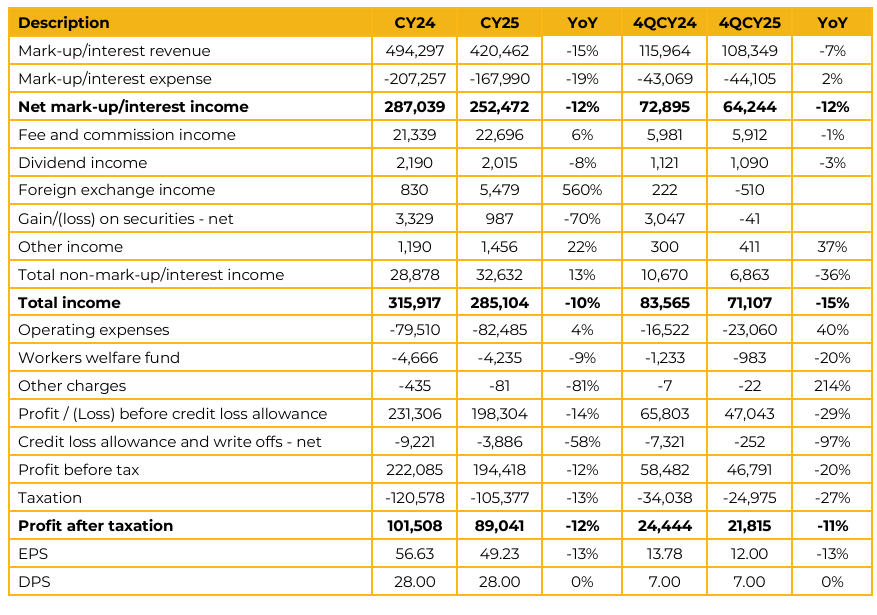

Meezan Bank Limited recorded earnings per share of PKR 49.23 in CY25, down 12% from PKR 56.63 in CY24. The bank recorded net interest income of PKR 252.5 Bn during CY25, down 12% from PKR 287.0 Bn in CY24. MEBL posted profit after tax of PKR 89.0 Bn in CY25, compared to PKR 101.5 Bn in CY24.

Total deposits grew 28% from PKR 2.6 Trn at Dec-24 to PKR 3.3 Trn at Dec-25. This growth was led by 29% growth in current account deposits followed by 21% growth in savings account deposits. Total investments stood at PKR 2.6 Trn, up 39% from PKR 1.9 Trn at end Dec-24. The portfolio consists of PKR 2.165 Trn in GIS, out of this 27% is in fixed rate products at an average yield of 11.4% and a duration of about 2.4 years.

The bank has opened 54 new branches in 2025 taking the tally to 1,105. Moving forward, it aims to continue to add 100-150 branches in 2026 in areas where surveys show there is demand from customers. CAR stood at 19.20% at end Dec-25, compared to 20.35% at end CY24. Management apprised that this was far above the regulatory requirement despite a modest decrease driven by an increase in the private sector credit portfolio, reclassification of investments from banking to trading book and the paying off of PKR 4 Bn tier-2 sukuk as well.

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.