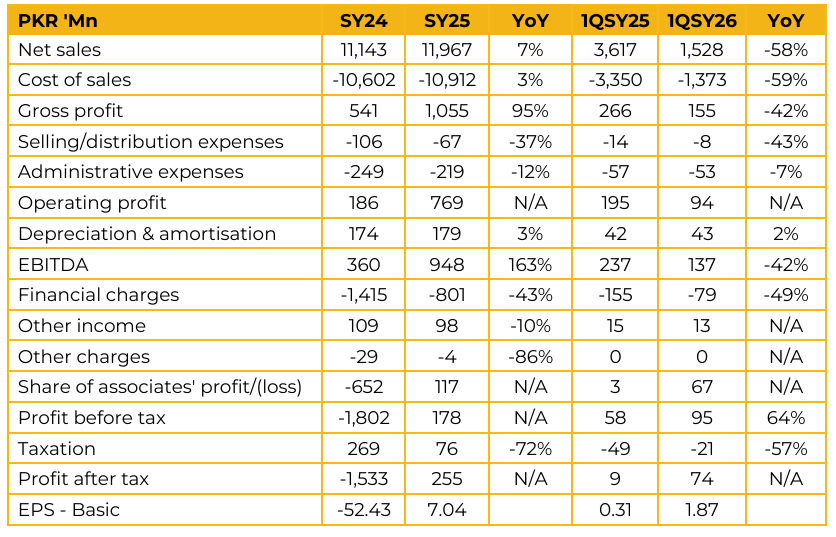

Faran Sugar Mills Limited (FRSM) reported earnings per share of PKR 7.04 for SY25, compared to loss per share of PKR 52.43 in SY24. Furthermore, in 1QSY26, the company reported earnings per share of PKR 1.87, compared to earnings per share of PKR 0.31 in the same period last year (SPLY). For the current season, production is projected to reach 6.9 million tons, compared to an estimated consumption of 6.6 million tons, resulting in a manageable surplus of approximately 300,000 tons. Sugarcane crushing commenced on December 5, 2025.

As of mid February 2026, the mill has crushed 526,000 tons of cane, producing 56,360 tons of refined sugar with an average recovery rate of 11.04%. Total solar capacity has been increased to 900 kW following the installation of an additional 600 kW solar system, strengthening the company’s renewable energy footprint. At the beginning of the season, sugarcane prices were PKR 425 per 40 kg, fluctuating significantly due to a demand supply imbalance in Sindh.

Current market rates range between PKR 540 and PKR 550, with the seasonal average expected to settle between PKR 475 and PKR 520. The acquisition of Popular Sugar Mills (Unicol) was valued at approximately PKR 6.5 billion. The transaction was financed through PKR 2.5 billion in internal cash and PKR 4.5 billion in leverage. For the quarter ending December 31, 2025, Unicol reported a total net profit of PKR 201 million, comprising PKR 140 million from Ethanol, PKR 52 million from the CO₂ segment, and PKR 28 million from Sugar.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.