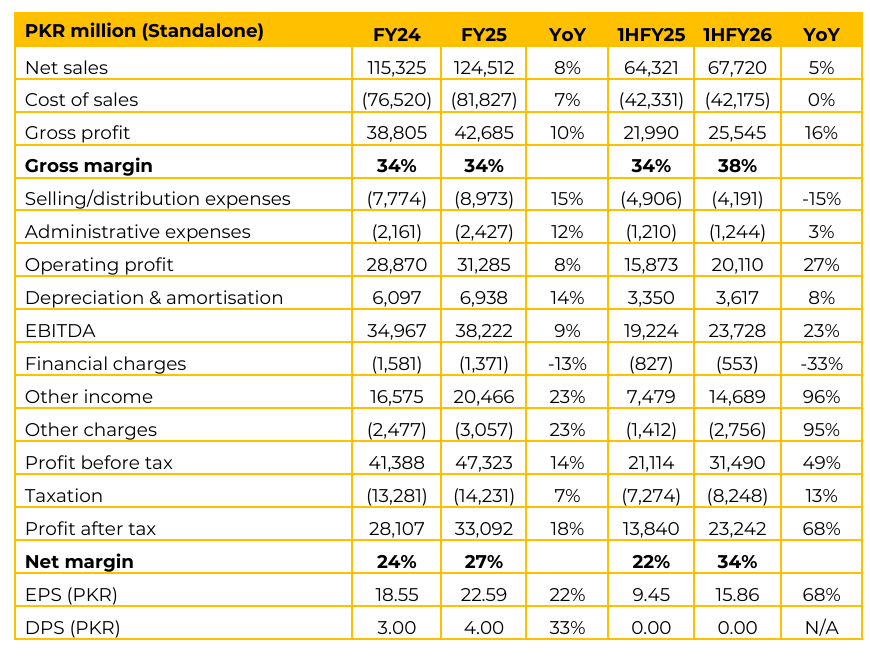

LUCK posted standalone EPS of PKR 15.86 in 1HFY26 (1HFY25: PKR 9.45), reflecting 68% YoY increase. While, net sales in 1HFY26 only grew by 5% to PKR 67.7 billion (1HFY25: PKR PKR 64.3 billion). There was a significant spike in other income, primarily due to a timing difference regarding dividend income from Lucky Electric, which was received in the first half of this fiscal year compared to the latter half of the previous year.

Management noted that while most sectors remained stable, Lucky Core Industries (LCI) faced challenges in its soda ash and polyester segments due to an adverse tariff regime. The effective tax rate was lower this period due to deferred tax estimations and the fact that dividend and investment income are taxed at lower rates. Regarding the Super Tax case, the Federal Court has issued a short order against taxpayers; however, the company maintains adequate cash reserves to manage any potential payments The industry saw a 12.5% growth in domestic demand. LUCK’s sales for 1HFY26 rose to 3.36 million tons, up from 2.98 million tons in the SPLY. LUCK’s market share remained relatively stable with a minor 0.1% drop.

However, export volumes decreased to 1.5 million tons (from 1.8 million tons) due to increased competition and the Afghan border closure, which caused a loss of approximately 100,000 tons. The average domestic retention for both North and South plants is approximately PKR 15,400 per ton. Management expects prices to remain stable or increase gradually due to inflationary pressures.

Lucky Cement is aggressively shifting to renewables, with 56% to 57% of its energy currently coming from solar, wind, and waste heat recovery. A new 15 MW solar plant is expected to come online in March 2026 with an estimated capital expenditure of PKR 1.2 billion. This will bring total solar capacity to 89.3 MW. The company invested PKR 3.5 billion to implement UC3 technology on two lines in Karachi. This technology allows the use of cheaper, high-sulfur coal while increasing clinker output, with an estimated payback period of 5 to 7 years With local coal supplies depleted and Afghan coal becoming too expensive and inaccessible, the company is now relying on imported coal.

The North plant faces additional freight costs of PKR 8,000 to 10,000 per ton for coal transported from Karachi. Going forward, the company announced a 1.6 million ton expansion of a fully integrated cement plant in Congo. Management expects overall industry growth to settle between 8% to 9% for the full year, accounting for slower activity during Ramadan and the monsoon season. Management views recent consolidation in the cement sector as positive. The company also continues to explore government privatization opportunities (following their interest in PIA) if the projects align with their investment portfolio.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.