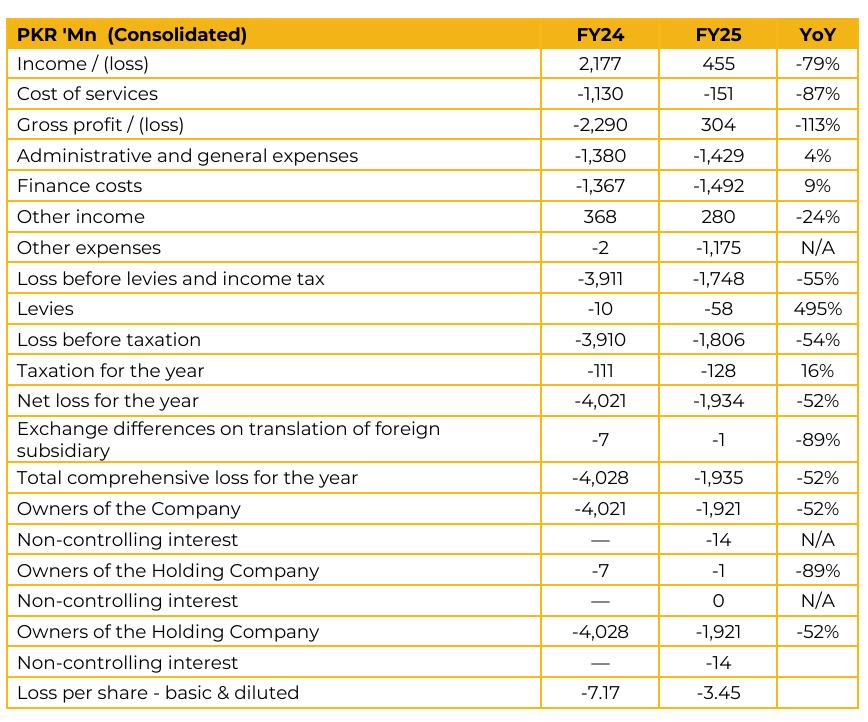

TPL Properties Limited (TPLP) reported Consolidated loss per share of PKR 3.45 for FY25, compared to loss per share of PKR 7.17 in FY24. TPLP earnings are primarily from dividend income received from its subsidiaries and the REIT fund, along with mark to market gains on its investment portfolio. While the company historically held a 38.02% stake, it has recently realigned its holding to 35% in TPL REIT Fund I to raise liquidity.

The Mangrove Project, a 40 acre mixed use development, represents approximately 90–95% of the total fund value. The project comprises 20 towers and is expected to be developed over a 10–12 year period. The TTZ Technology Park plot is in the process of being sold, with the technology park concept now relocated to the Mangrove site. Proceeds from the sale are intended to be reinvested into the Mangrove project.

TPL is in discussions to enter into a partnership with a major local developer, which could potentially shorten the Mangrove project timeline from 10–12 years to 7–9 years, thereby accelerating dividend distributions. Recent infrastructure developments, including the Korangi Causeway bridge and the Malir Expressway interchange, are expected to materially reduce travel time to the project site.

The sale of TTZ plot is currently facing delays due to a court stay order related to the conversion of land from industrial to commercial use. The Maldives project has also experienced delays due to geopolitical factors, although management continues to pursue the opportunity through its foreign subsidiary. TPL Properties holds a 35% stake in TPL REIT Fund I and receives dividend income from fund distributions. To retain tax exempt status, the REIT fund must distribute at least 90% of its profits to unit holders.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.