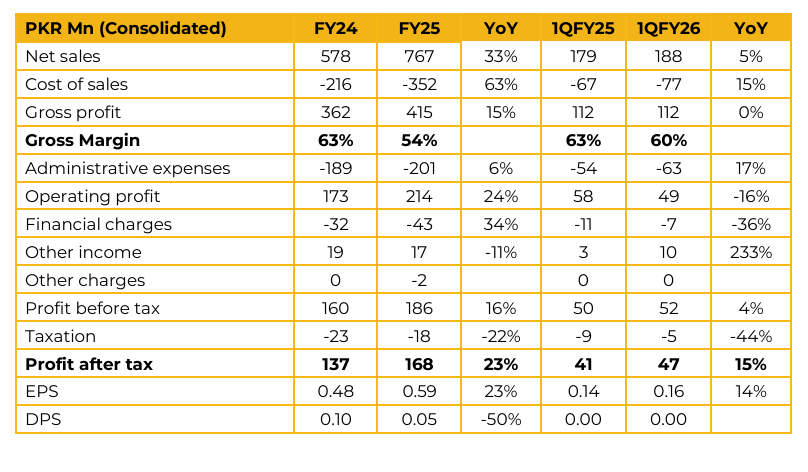

Symmetry Group Limited recorded consolidated earnings per share of PKR 0.59 in FY25, as compared to PKR 0.48 in FY24.

The company recorded net sales of PKR 767 Mn, up 33% from PKR 578 Mn in FY24. During FY25, the company’s gross margin fell to 54%, down from 63% in FY24. Along with this, it saw its gross profit surge 15% from PKR 362 Mn in FY24 to PKR 415 Mn in FY25.

SYM posted profit after tax of PKR 168 Mn in FY25, compared to PKR 137 Mn in FY24

The company boasts a total of 46 clients including large companies like Jazz, Colgate and Onic which it serves through its 185 employees based in 4 offices.

The operations are spread across 4 core areas; interactive, transformation, commerce and mobility.

The top 5 local customers are Jazz, HBL, SBP/NBP, JS Bank and MCB bank. The top 5 export customers are Al- Waha Computers, Humming bird, S Ventures, Digicel (prism holdings) and Luminus trading.

The revenue mix by geography is as follows:

Pakistan: 44%

MENA: 47%

North America: 9%

Similarly, the revenue mix by business segment is:

Transformation: 81%

Interactive: 19%

With regards to strategic partnerships, it apprised that partnerships with Backbase, Codebase, Glu and Spotify are expected to be pursued in the near future. It was clarified that the Spotify deal had been delayed due to the change in regions from APAC to MENA which caused a slowdown in the processing.

Moving forward, the company plans to utilize AI in more of its operations to increase productivity. Management also apprised that it plans to IPO its subsidiary, Aurion.ai, with filing of IPO application expected in Jan-26.

The company is also looking into potential already profitable acquisitions both in and out of Pakistan which can help grow the business. As always, the company believes in research and development and hopes to continue investing in the same to develop improved solutions for both current and prospective clients.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.