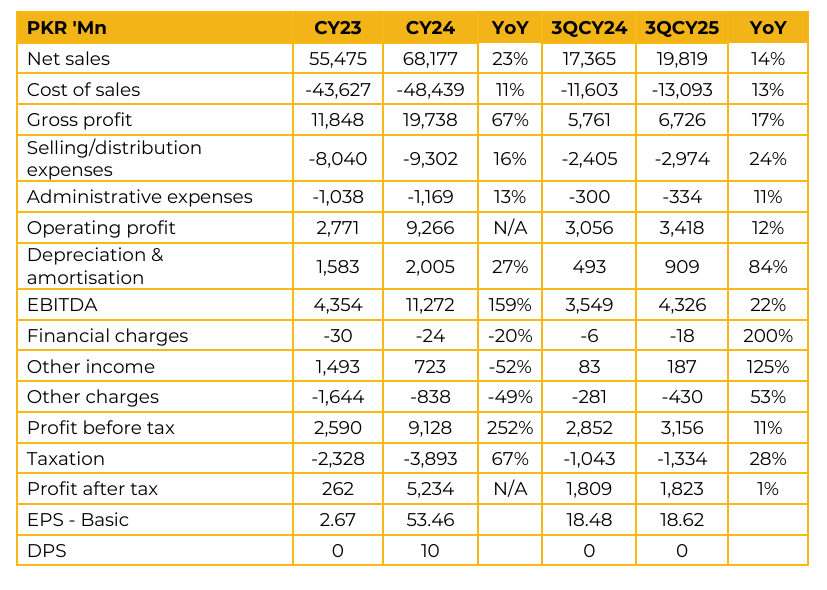

Abbott Laboratories (Pakistan) Limited (ABOT) reported earnings per share of PKR 53.46 for CY24, compared to earnings per share of PKR 2.67 in CY23. Furthermore, in 3QCY25, the company reported earnings per share of PKR 18.62, compared to earnings per share of PKR 18.48 in the same period last year (SPLY). Pharmaceuticals comprise 70% of total revenue. In 9MCY25, the pharmaceuticals segment grew 16%, driven by 14% price and 2% volume. In adult nutrition, 9MCY25 growth was primarily driven by 18% price and 1% volume.

Management stated that Abbott holds over 90% market share in the adult nutrition segment. The diagnostics segment recorded a 16% decline in 9MCY25, largely due to a one off government tender in 2024 that did not repeat in 2025. Management noted that approximately 50% of the pharma portfolio is essential and 50% is non essential. Essential product pricing is linked to CPI, which management views as a risk if inflation remains low.

Management also highlighted the successful launch of Brufen Duo, which was the first product developed at the company’s in house technical centre. The company’s API sourcing mix is 70% imported and 30% local. Gross margins in the pharmaceuticals segment remain volatile, primarily due to changes in product mix. While the company remains aligned with the government’s export targets, management highlighted instability in the Afghanistan market as a key industry risk. Abbott’s exports to Afghanistan currently account for less than 1% of sales.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose