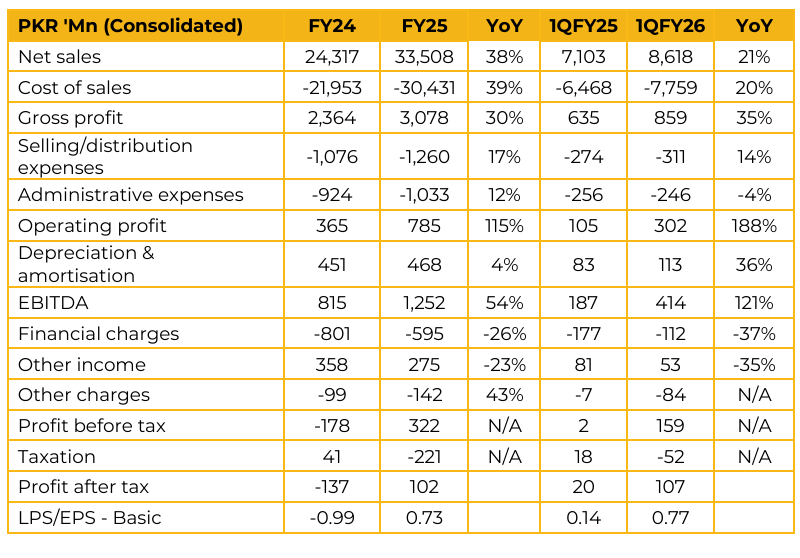

Hi-Tech Lubricants Limited (HTL) reported consolidated earnings per share of PKR 0.73 for FY25, compared to loss per share of PKR 0.99 in FY24. Furthermore, in 1QFY26, the company reported earnings per share of PKR 0.77, compared to earnings per share of PKR 0.14 in the same period last year (SPLY). The decline in financial performance in prior years was primarily driven by the company’s inability to maintain price competitiveness, as it relied on importing fully finished premium products during a period of PKR devaluation.

This resulted in low sales volumes. For FY26, management guided volumes of more than 12m litres (25% growth vs 9.5m litres in FY25), with a forecasted PAT contribution of PKR 400–500m. In the OMC segment, growth is expected to be supported by new sites, with incremental earnings from new COCO sites estimated at PKR 180–200m. Overall, management provided a conservative profit forecast of PKR 600m. In OMCs, plans include establishing a storage facility in Daulatpur, which is expected to enable licensing for approximately 40 additional fuel stations.

The company is also rationalizing the network by removing underperforming stations and issuing licenses to new, better performing dealers. Within the lubricant portfolio, the premium Grey and Blue series deliver better margins, while the Red series (motorcycle and diesel oils) is a high-volume, price-sensitive category and therefore carries lower margins. The Polymer Division remains at an early stage, but has demonstrated rapid improvement.

Management expects the segment to move into a positive and profitable trajectory in FY26. Historically, HTL imported finished goods at a higher duty rate, while competitors imported raw materials at 10–12%. HTL has now shifted to importing base oil and additives as raw materials for local blending, availing a duty structure benefit. local blending started in July 2025. HTL remains bound under its agreement with South Korea for premium base oils, but intends to re-engage in discussions to potentially source more cost-effective Group I base oil from local refineries for price-sensitive categories such as motorcycle oil and diesel.

Management does not anticipate a near-term material impact from EV adoption in Pakistan, particularly given the dominance of diesel, tractor, and motorcycle segments in volumes, implying the lubricant demand runway remains intact for the next 5–7 years.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.