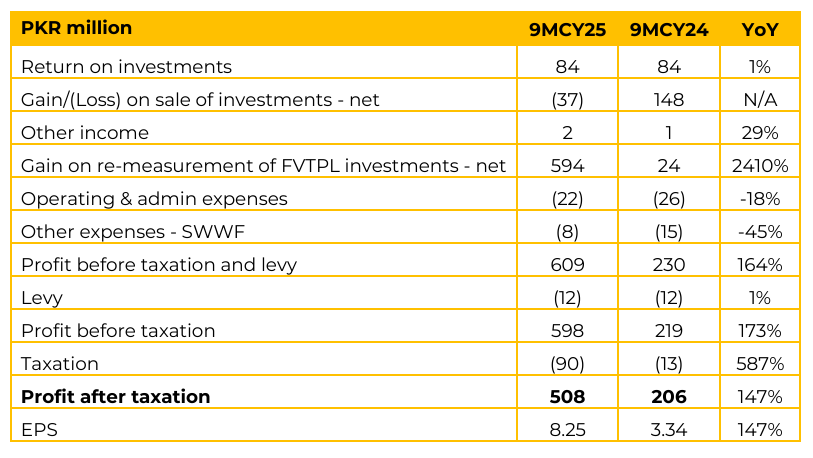

Cyan reported earnings per share of PKR 8.25 in FY25 vs EPS of PKR 3.34 in FY24. The company invests in high-quality businesses at attractive valuations. The primary objective is long-term value creation for shareholders. Over the last two or three years, CYAN has strategically pivoted its focus from trading to a long-term value-driven investment thesis, focusing on investing in businesses rather than just “scrips”.

Overall portfolio size stands at PKR 1.6 billion. Cash and equivalent holdings are PKR 74 million. The company’s portfolio is heavily concentrated in sectors that have driven outperformance. 57% allocation is in Banks, has given really good profits over the last two to three years. E&P allocation is 21%, IT sector has 11% while the residual includes Pharma and Fertilizer.

Management submitted a proposal to the Board for the amalgamation of three companies: DHPL, CYAN, and Dawood Lawrencepur. The amalgamation is intended to create value for shareholders through simplified governance structure, increased synergies, expanded investment avenues and a stable balance sheet.

Important Disclosures

Disclaimer: 3.34 147% This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.