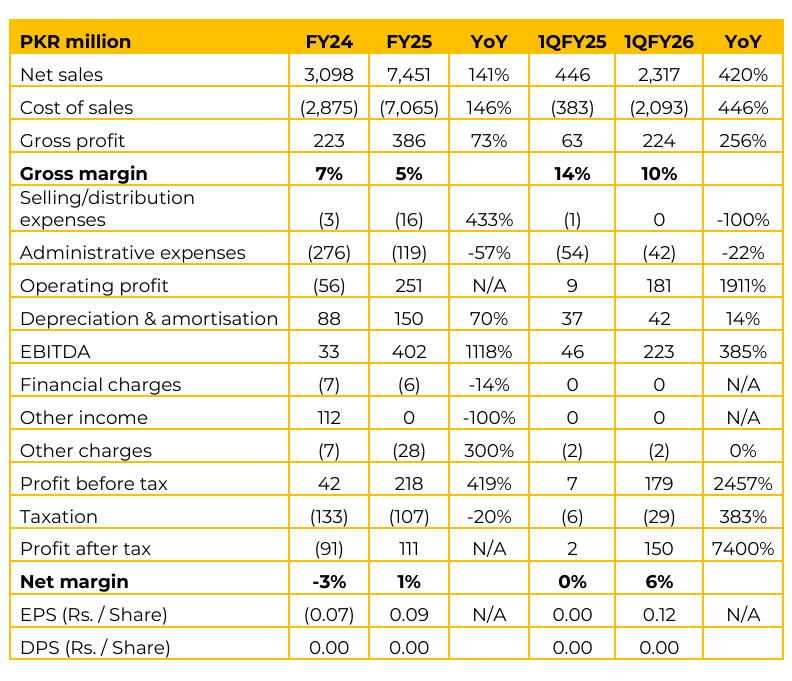

BECO reported earnings per share of PKR 0.09 in FY25 vs loss per share of PKR 0.07 in FY24. In 1QFY26, the EPS remained PKR 0.12 (1QFY25: 0.00).

Management projects that sales will double once the new plant becomes operational. The target sales for the upcoming fiscal years FY26-27 are projected to reach around PKR 15 billion. Gross margins are expected to remain stable. This stability is contingent on international fluctuations remaining minimal and the current import rate not being significantly affected. The copper market is highly volatile, being dependent on the London Metal Exchange.

Current margins in copper sales are described as good and quite better. Profitability is currently high because the LME for commodities including gold and copper is increasing. Management noted uncertainty regarding future profitability if a market slump occurs.

The rebar plant is anticipated to come online around October 2026. The overall new plant construction is the primary focus, and the funds raised will be used for setting up the new plant machinery and the 5 MW solar setup. The per-unit cost to produce rebar is approximately 50 rupees per kg.

This cost calculation includes re-melt, continuous casting, and rolling processes. The production process consumes a total of 810-820 units of WAPDA electricity per ton of rebar. BECO currently sells Angles indirectly to WAPDA through other sources. These intermediate companies galvanize the raw product before selling it to WAPDA.

The company is currently seeking approval and expects to receive news within a month regarding the ability to galvanize and sell directly to WAPDA. The company currently carries land on a cost basis. There are no plans for revaluation no such revaluation is currently on the balance sheet. The recent increase in authorized capital and the sale of shares by the sponsor were executed to secure funds for the new plant. The company is avoiding external loans/financing and relies on internal funding. All proceeds from the recent shares sold by the sponsor will be introduced into the company as a loan from directors.

The balance sheet already reflects approximately PKR 240 million in loans provided by sponsors, with no bank financing. BECO’s current line of business differs slightly from its main competitors. The company primarily focuses on B2B selling. Round Bars are sold for use in items like motor shafts/rotors are supplied to companies such as GFC Fans, Pak Fans, and Millat. Angles are sold for WAPDA requirements.

Channels are used in the upper structure of solar installations, capitalizing on the current solar market boom. Amreli and Mughal, focus on rebar/deformed bars. BECO currently does not directly compete with them. However, once the new plant is operational, BECO will produce Rebars and Deformed Bars. The company expects to be cost-effective and will then be positioned to compete directly with Amreli and Mughal.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.