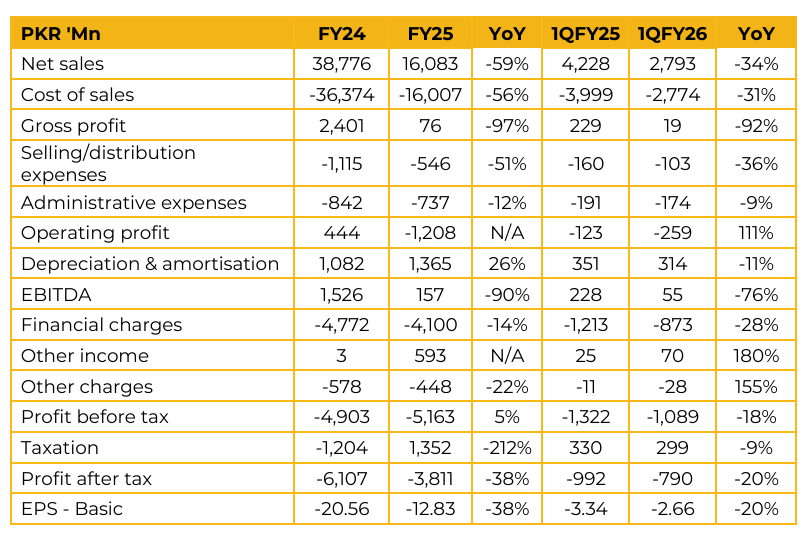

Amreli Steels Limited (ASTL) reported loss per share of PKR 12.83 for FY25, compared to loss per share of PKR 20.56 in FY24. Furthermore, in 1QFY26, the company reported loss per share of PKR 2.66, compared to loss per share of PKR 3.34 in the same period last year (SPLY).

The company reported a decline in topline of PKR 22 billion, driven primarily by restructuring-related disruptions, including blocked working capital lines and resulting material shortages that constrained production volumes. The Company benefited from lower scrap prices (down from USD 433/ton to USD 409/ton on average) and reduced electricity tariffs (from PKR 45/kWh to PKR 34/kWh), these gains were offset by the inability to procure sufficient raw materials, resulting in lower capacity utilization.

Management noted that the 90-day lead time for material arrivals post-MRA, coupled with winter and Ramadan seasonality, suggests that operational normalization and meaningful improvement in profitability may only become evident around 18 months after the MRA becomes effective.

The Principal repayments feature a three-year grace period followed by a seven year repayment schedule with balloon payments in the last three years. The first repayment is expected to commence in FY28. The MRA incorporates a cash sweep mechanism under which, if actual cash flows exceed projections, 50% of excess cash must be used to repay lenders while the remaining 50% is retained for working capital.

Following the effectiveness of the MRA, management’s strategy is to ramp up production as working capital lines reopen and cash conserved during the moratorium is redeployed into operations. The company aims to achieve production of around 200,000 tons equivalent to 38–40% capacity utilization which is the break-even level. Profitability is expected to begin at 45–50% utilization. Management has begun re-engaging its historic dealer network (previously 365 dealers) through nationwide roadshows, targeting a return to the company’s earlier 7–8% market share. Given the extremely low current base, initial volume growth is expected to be steep.

Under the restructuring agreement, the company will receive a three year interest moratorium (FY25–FY27) on the restricted loan. Mark up will continue to accrue but will be deferred, with repayment beginning in the sixth year (after a three-year moratorium plus a two-year grace period).

The restructured amount will carry KIBOR with no spread throughout the 10-year repayment tenure. The side rolling mill is expected to remain idle until utilization meaningfully improves, potentially in FY28 or FY29. Reduced electricity tariffs have also narrowed the competitive advantage of sugar/bagasse-based rolling mills, as freight costs effectively offset their cheaper power when supplying the southern region.

ASTL stands to be a major beneficiary if the government reinstates the subsidy on incremental electricity units, given its currently low utilization and high reliance on melting units. While current product premiums remain elevated, management intends to rationalize prices as volumes recover, aiming to sustain a premium of PKR 7,000–8,000 over market rates in the long term.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.