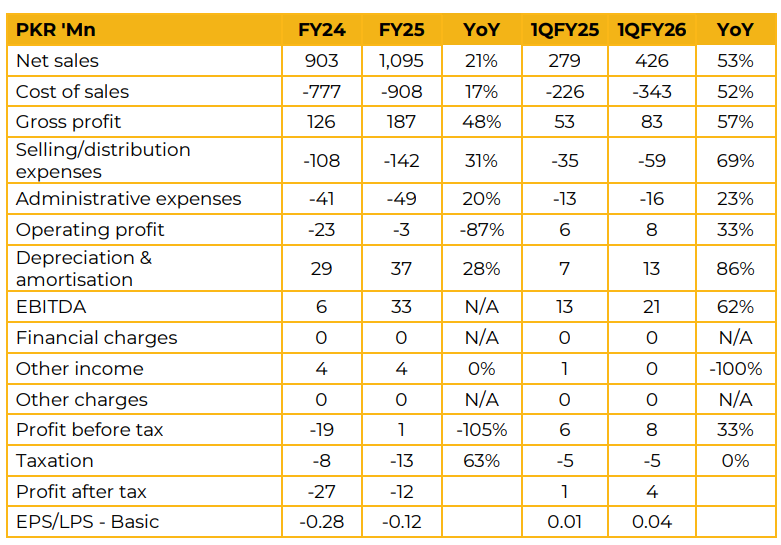

Quice Food Industries Limited (QUICE) reported loss per share of PKR 0.12 for FY25, compared to loss per share of PKR 0.28 in FY24. Furthermore, in 1QFY26, the company reported earnings per share of PKR 0.04, compared to earnings per share of PKR 0.01 in the same period last year (SPLY). Local sales increased significantly, rising from PKR 436 million to PKR 760 million.

Export sales declined slightly compared to last year. The current export portfolio is primarily composed of Tetra pack and CSD products. Management aims to increase export revenue by 50% from the current level of PKR 549 million. The mineral water plant has now been installed and commercial production has commenced, contributing meaningfully to topline growth. However, margins remain thin, gross profit is approximately 9–10% due to low value addition in the water segment.

A Prisma Tetra machine has also been commissioned, enabling production in larger packs, which complement the existing smaller SKUs. Two new Carbonated Soft Drink (CSD)/Cola plants were operationalised during the year. Management noted that a broader consumer shift toward local brands supported robust growth in this segment. Local CSD sales rose sharply from 81,000 cartons to 217,000 cartons.

Sales of Naseeb Masala declined from 9,000 cartons to 4,500 cartons. The company plans to restructure this division in December, including the hiring of new production and sales teams and expanding its presence across retail outlets. Operational capacity remains significantly underutilized across multiple categories: syrups (capacity 1.4 million vs. production 572,000), juices (17 million vs. 4.2 million), water (6.9 million vs. 4.1 million), and CSD (5.7 million vs. 1.7 million cartons). The imposition of 20% FED by the government continues to weigh on profitability, as the market has been unable to absorb the price increase, forcing the company to bear the cost. The company has hired new sales teams across Punjab, KPK, Azad Jammu & Kashmir, and Gilgit-Baltistan to build a distribution network and appoint city-wise distributors Management is placing particular emphasis on export expansion to offset the rising tax burden in the domestic market.

The company regularly participates in major international food exhibitions such as Gulf, Europe, and events in Saudi Arabia and the US to increase exports. Export volumes of tetra-pack products stood at 457,000 cartons compared to 320,000 cartons last year, while CSD exports were 17,000 cartons. Management expects both CSD and tetra-pack exports to grow further in the coming year.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.