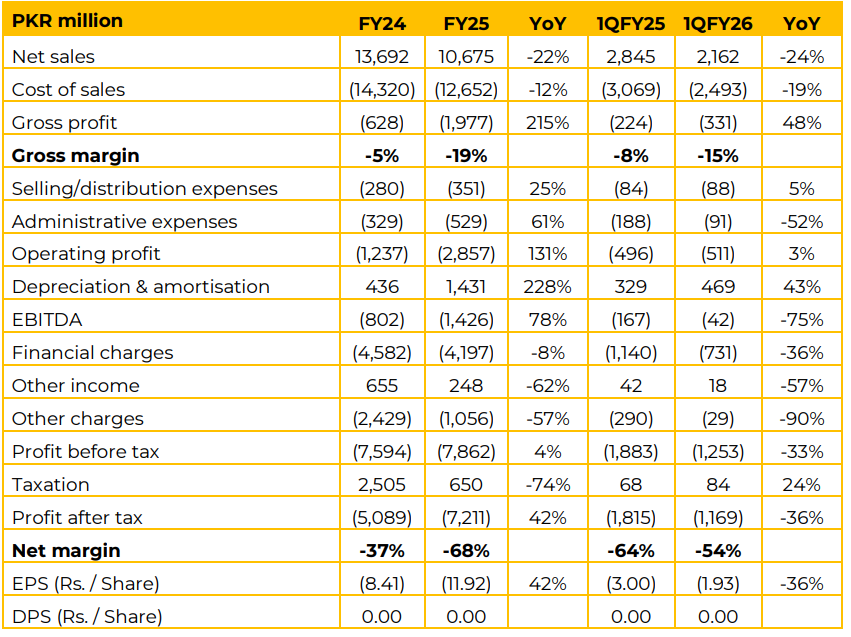

AGHA reported loss per share of PKR 11.92 in FY25 (F24: 8.41). In 1QFY26, the LPS remained PKR 1.93 (1QFY25: 3.00). AGHA has faced severe turbulence over the last 1.5 years, largely due to a major fire incident in 2023 which disrupted operations and banking relationships, necessitating a comprehensive debt restructuring.

Management expressed that the overall steel sector demand has plummeted from 5 million tons to 3 million tons, and the future outlook for significant demand increase is conservative, tied heavily to Government policies, PSDP, and CPEC activity. The company is in the final stage of negotiation for debt restructuring.

Restructuring has been approved by the major/primary banks. Management expects the restructuring transaction to be concluded shortly, within two to three months. The total size of the debt being restructured is approximately PKR 22.5 billion (PKR 8 billion long-term debt + PKR 14.5 billion short-term debt), plus accrued mark-up.

Management clarified that the accrued interest is simple interest, not compound interest, meaning interest will not accrue on existing interest. This prevents the loss from increasing further due to compounding effects. The saved cash flow will be utilized to fund the MiDa project and meet working capital requirements. Projections shared with lenders are based on conservative assumptions, including only a 10% year-on-year increase in demand.

These projections confirm that the company can meet its obligations within the 10-year period, even given the current conservative pricing and demand scenario. Management committed to sharing these projections along with finalized terms and letters with investors the day the signed, finalized terms are received from the banks. Current production capacity utilization is low, at a maximum of 25%. The main factor impeding production is the working capital constraint. The target production utilization is to jump to at least 30%, 40%, or 50%.

Management asserts that if working capital constraints are resolved, volume could significantly increase, even if demand remains stagnant.

However, another management viewpoint suggested that demand disruption is the primary problem, and demand automatically generates liquidity/working capital. MiDa project is almost 75% complete. A further PKR 2 billion in capital expenditure is required to fully complete and operate the project.

Completion of the project is a priority for utilizing internally generated cash flows over the next two years. Even running the MiDa project at 50% capacity will provide energy cost savings. If demand remains extremely low, the management has alternative options, including seeking a potential buyer for the project. Energy cost is the second-largest cost segment after raw material. Agha Steel has installed solar capacity of around 2.2 MW.

This solar capacity is insufficient for running the furnace, which requires significant electricity. Management highlighted that steel industry demand has slumped from 5 million tons to 3 million tons. The industry is facing hard struggles due to factors like smuggling and low economic activity. The Real Estate sector is depressed due to IMF-mandated tax reforms, further suppressing construction demand. Major long-term growth hinges on PSDP and CPEC movement. The government has announced an incremental package to stimulate the industry.

However, details are currently unclear, with issues outstanding regarding NEPRA, KCCI, PCCI discussions, and the applicable calculation model. Listed steel companies account for no more than 20% of the market share. Combined formal steel companies would have a market share of 40-45%. Agha Steel views itself as the only solution provider in Pakistan capable of utilizing indigenous iron ore through a blast furnace and associated facilities. The company already possesses 60- 70% of the required facilities, requiring only 30% backward integration to utilize the country’s iron ore resource.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.