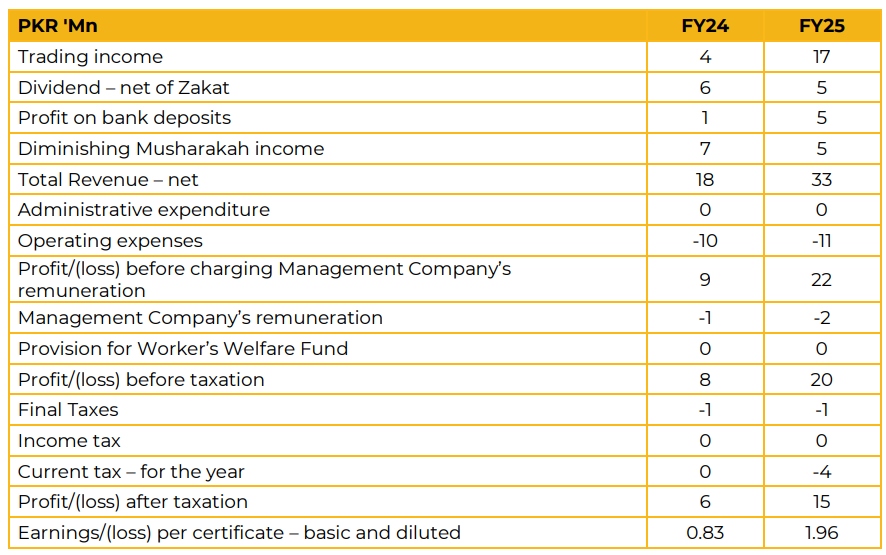

B.F Modaraba (BFMOD) reported earnings per share of PKR 1.96 for FY25, compared to earnings per share of PKR 0.83 in FY24. Sugar trading continues to be highlighted as their key operational focus, fully aligned with the broader Group’s longstanding expertise in the sector.

Leveraging the Bawani Group’s extensive experience in this business, the Modaraba is well-positioned to capitalize on seasonal opportunities within the sugar market. Management intends to re-enter sugar trading in the upcoming season, with purchases expected between January and March.

While acknowledging that market rates are likely to decline, management emphasized that the Modaraba currently holds no sugar inventory. Trading will resume only once mills commence operations, prices stabilize, and a clearer view of the forward market emerges.

The company investment portfolio remains focused on long-term positions in blue-chip stocks that offer stable yield. Current direct equity exposure stands at approximately PKR 20 million, while the remainder of reserve funds is deployed indirectly through Mutual Funds and Equity Funds. The Modaraba currently operates four large vehicles under its leasing book, primarily Prado units. These vehicles are leased to a Group company engaged in construction activities, supporting predictable rental income streams

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.