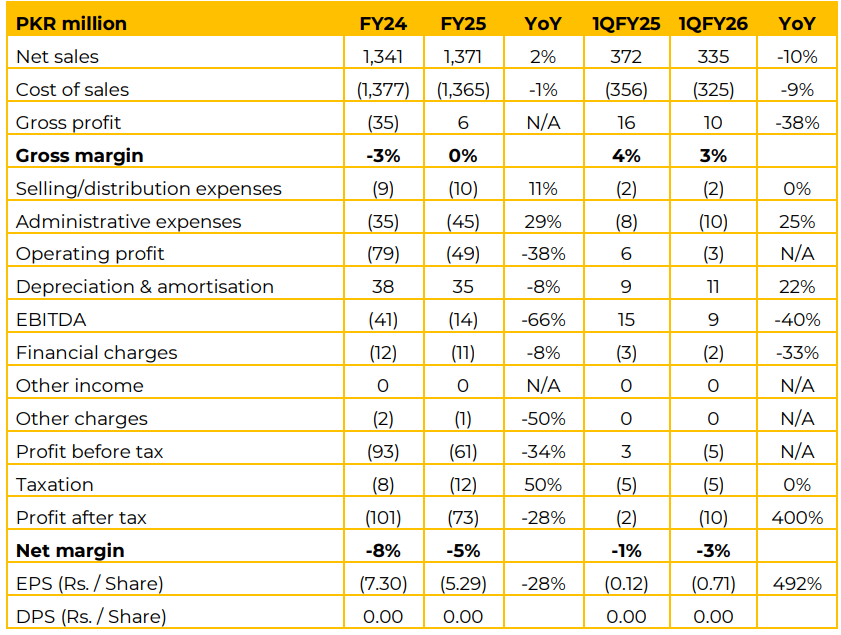

SERT reported loss per share of PKR 5.29 in FY25 vs loss per share of PKR 7.30 in FY24. Furthermore, in 1QFY26, LPS remained PKR 0.71 (LPS 1QFY25: 0.12). SERT currently operates 20,000 spindles.

The company primarily produces cotton yarn. SERT sells all its products in the local market only. SERT is considered one of the oldest business groups, and the management commented that it is assured that the company will not shut down unless the entire Pakistan textile sector ceases operations.

The company faces high energy prices, which are approximately double the regional cost. SERT utilizes three main energy sources: the Grid, a gas generator, and solar power. The gas generator previously used, but no longer viable/running because it has shifted to LNG (which is expensive). Installed solar capacity is approximately 800 KW. Goal is to increase 35% to 40% of energy cost coverage.

Total energy requirement is estimated to be around 3 MW. The Government’s recent efforts to provide cheaper electricity for industries are expected to have an impact, but the extent and percentages of the benefit are currently uncertain due to ongoing clarifications regarding differential units and average calculations.

The quality of local cotton is poor due to the use of pirated seeds in Pakistan, which temporarily increases quantity but leads to subsequent problems with pests and other factors. Farmers are not receiving adequate compensation, leading to issues like the sugar industry moving into the cotton belt, which affects production. The company must ultimately use imported cotton this year due to local unavailability and quality concerns. Historically, SERT sourced quality cotton from Central Asia via Afghanistan, but those routes have been closed, which is a major blow to the textile industry.

Direct imports via opening LCs require a 100% margin or relying on bank support. SERT is self-financing its working capital, often managing through creditors, extending the working cycle from 15 days to 30 days. The company has no bank financing. Sourcing companies are now being utilized to help manage imports.

Margins have been squeezed because many exporters, facing decreased export margins, shifted into the local market, making it difficult for local players like SERT. Going forward, the immediate future is expected to be difficult, particularly until after March when the new local crop begins to arrive.

Current margins are shrinking. Management believes the company will remain stuck in the current cycle, only exiting and re-entering it every few years because national policies remain undefined. The current strategy centers on decreasing the cost of production (primarily through optimizing solar power usage).

Management expressed that they do not see an immediate positive future for the Pakistani economy or the specific segment of Punjab-based textile mills.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.